Blogs

Common Challenges Facing KYC Protocols

Do you have the right processes and protocols in place to protect against fraud, money laundering, and the many other risks that come with operating in today’s market? Know Your Customer and Customer Due Diligence, otherwise known as KYC and CDD, play a major role in...

How KYC Protocols Build Customer Trust

If you’ve followed along on any of our previous KYC blogs or are a subscriber of our Regwatch newsletter, you know just how important it is to stay on top of evolving KYC, AML, CFT, and CDD legislation. With criminal activity and fraud becoming increasingly complex,...

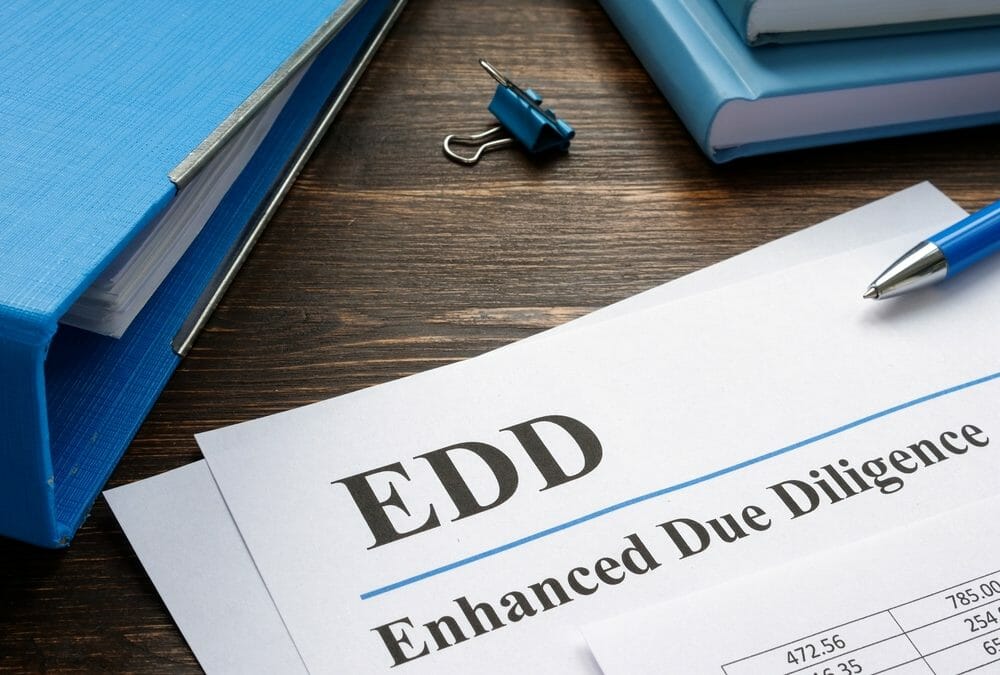

Taking a Closer Look at Enhanced Due Diligence

Enhanced Due Diligence (EDD) is one of the best ways to protect your business, as well as your customers, against the risks associated with fraudulent activities, money laundering, terrorist funding, and more. As a higher level of verification and identity...

How Does Edge Computing Assist with KYC?

As one of the most formidable technical features available on the market, edge computing gives KYC and AML solutions such as iComplyKYC a huge advantage when it comes to ensuring the privacy and security of customer data during identity verification and compliance...

What is KYC? Breaking Down the Basics of Know Your Customer

Know Your Customer (KYC) protocols have become an essential part of anti-fraud legislation designed to circumvent money laundering, the funding of illicit activities, protect customer data and provide other levels of heightened security. KYC processes are heavily...

Key Reasons KYC Processes Fail

How effective are your KYC protocols for financial crime compliance? In the first half of 2021, banks and financial institutions accrued over USD $1.9 Billion in AML fines, and current data shows no signs of the trend slowing down. With the EU introducing a new...

Fraud Fundamentals: KYC Tips to Protect Your Business

Is your business effectively managing critical KYC protocols and procedures? As an increasing point of concern and regulation in the global market, Know Your Customer (KYC) practices have become vital tools that protect businesses and their customers from fraudulent...

Stay on Top of Financial KYC and CDD with iComply

In order to stay up to date with increasingly complex and evolving digital security, fraud, and anti-money laundering practices, the United States’ Financial Crimes Enforcement Network (FinCEN) amended the Bank Secrecy Act to introduce final rules with regard to the...

Legal Entity Management, Streamlined: Meet iComplyKYC

Staying on top of corporate governance regulations can be one of the most time-consuming and costly aspects of running a business. However, this is essential to ensure your operations are compliant with all jurisdictional standards and run as smoothly as possible....

Know Your Customer, Protect Your Bottom Line

In today’s busy global market, the need for security and transparency is greater than ever before. The rapid pace and advancement of digital technology have led to great leaps and bounds when it...

Invest in Banking & Finance KYC Solutions You Can Trust

Are you set up for success when it comes to compliance with the many safety regulations that moderate the finance and banking sectors? If your institution is lagging when it comes to KYC and AML...

Sanctions Update: Russia, Ukraine, and Global Uncertainty

Recent Russian sanctions and what organizations can do to ensure compliance coverage for the most up-to-date information on changing sanctions updates

MIT Exec and Trusted Computing Expert Thomas Hardjono Joins iComply

MIT Exec and Trusted Computing Expert Thomas Hardjono Joins iComply’s Advisory Board

iComply Attracts Top Canadian RegTech Executive Paul Childerhose

iComply Investor Services appoints Canadian Regtech expert Paul Childerhose to Advisory Board

iComply Investor Services Named a CyberTech100 Company for 2021

The CyberTech100 list for 2021 recognizes the world’s most innovative companies focused on helping financial institutions combat cyber threats and fraud

New Thomson Reuters Marketplace Selects iComplyKYC as a Digital Identity and KYC Partner

Thomson Reuters has launched its Marketplace, featuring a curated selection of software solutions for law firms, corporate law offices, and tax and accounting professionals

iComplyKYC Q1 2021 Product Updates

The latest notes from iComply’s most comprehensive release yet, with more workflow automation, enhanced security features, and several UI enhancements.

Fireside Chat: The New Consumer: How to Ensure Integrity in the Virtual Economy

Join our live fireside chat to learn how proper compliance for consumers, vendors, and payment processors can foster stability in virtual marketplaces

Fireside Chat: Mergers & Acquisitions: The Future of Enhanced Due Diligence

Join our latest live fireside chat to learn more about the most impactful trends in enhanced due diligence for merger and acquisition transactions

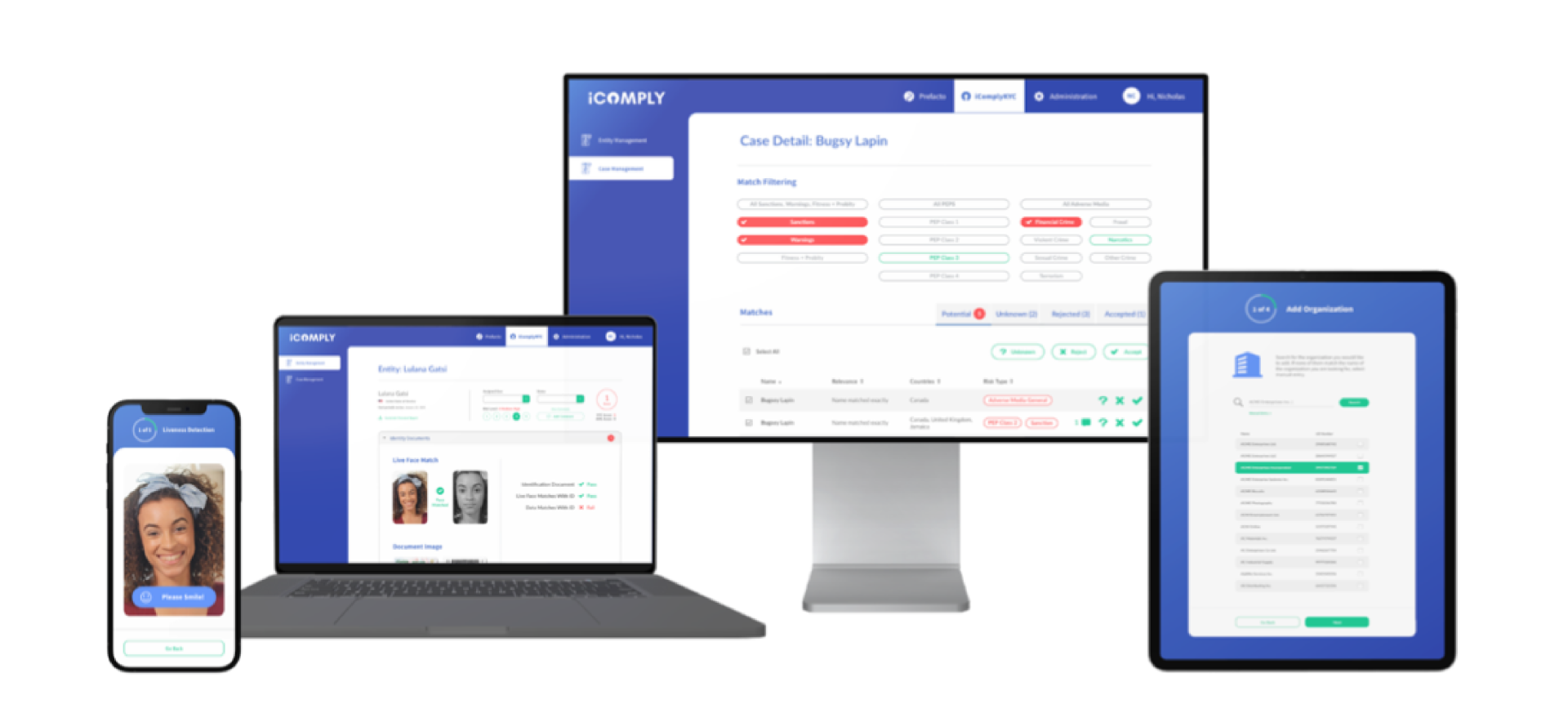

iComply Launches Digital Compliance Administration Platform for $181 Billion KYC and AML Market

Updated iComplyKYC platform leverages edge computing and AI to support onboarding and ID verification for legal entities and natural persons

Fireside Chat: How Compliance Changed in 2020

Join our latest live fireside chat to learn more about how the global impact of AMLD5 shifted the landscape of compliance in 2020

Legal Agreements