Unlock the Potential of Tokenization with iComply – Prefacto™

Pioneering Global Standards for Digital Asset Markets

Tokenization is reshaping the global capital markets. Capitalize on the shift with our patent-protected technology, helping businesses meet compliance and security requirements at scale.

What is Prefacto™?

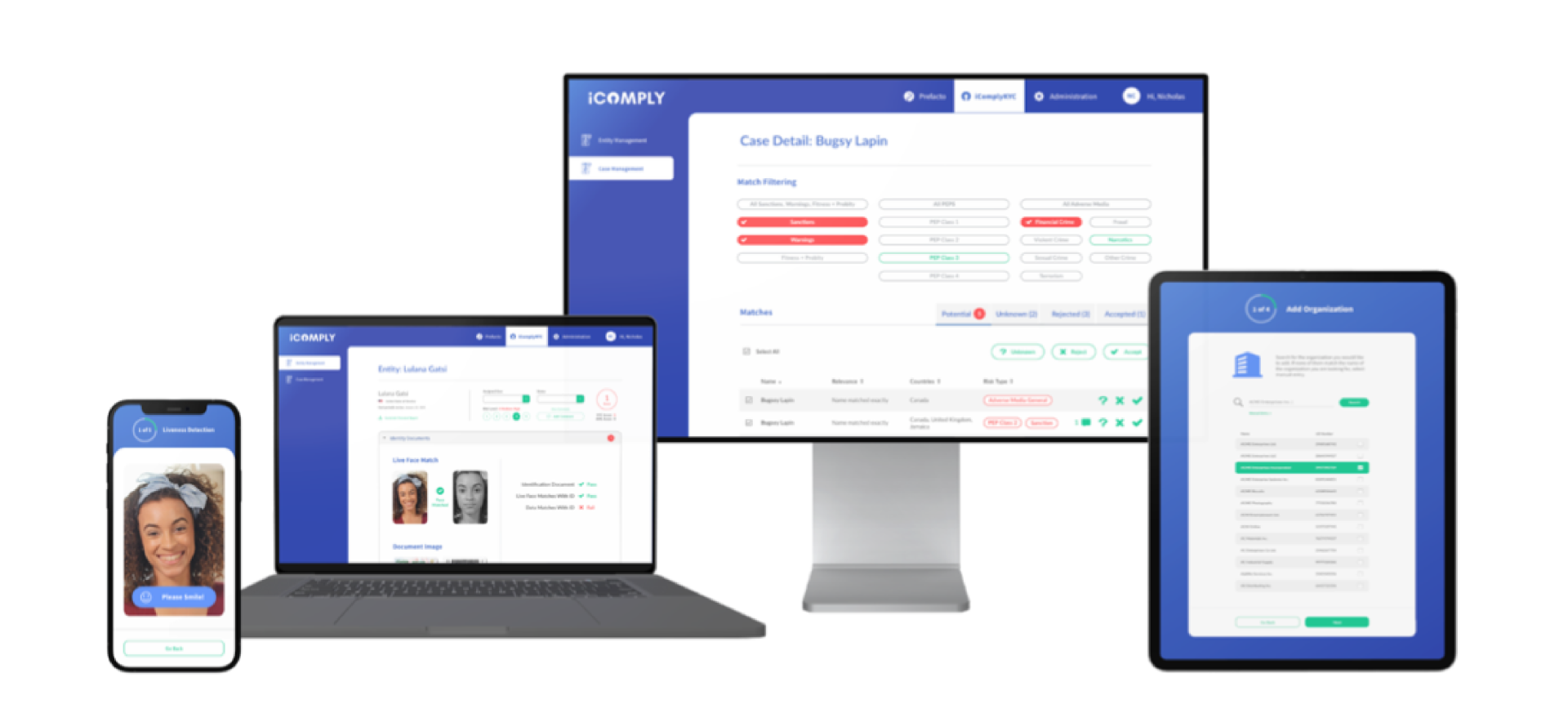

Our patented, turn-key, non-custodial security token management technology enables you to interweave any blockchain into your existing IAM, KYC, or risk solution. Tap into the power of blockchain without compromising on compliance, scalability, or user experience.

How Prefacto™ Works

Prefacto™ is a powerful asset for your business. As a strategic partner, we equip you with our patented technology, enabling you to leverage our partners or develop your own unique, compliant tokenization solutions that align with your business needs and market dynamics.

Address Whitelisting

Prefacto allows for the identification and approval of specific blockchain addresses, ensuring that only these whitelisted addresses can participate in token transactions. This is fundamental for ensuring that only verified and compliant entities or individuals are interacting with the token.

Transaction Validators

Beyond just the approval of addresses, Prefacto can also oversee each transaction on the blockchain to ensure that they adhere to set parameters or compliance regulations. This ensures that even if an address is whitelisted, the transactions they’re participating in are still compliant.

Why Choose Prefacto™?

Licensing Opportunities

Token Issuers

For businesses who have issued security tokens, stablecoins, non-fungible tokens (NFTs) or central bank digital currencies (CBDCs) with whitelists, off-chain validation, burning, or freezing of transactions.

Token Platforms

For technology platforms issuing or facilitating the trading of security tokens, stablecoins, non-fungible tokens (NFTs), central bank digital currencies (CBDCs), and digital identity on blockchain.

Strategic Partners

For data and software companies providing compliance solutions for security tokens, stablecoins, non-fungible tokens (NFTs) central bank digital currencies (CBDCs), and digital identity on blockchain.

Reseller Partners

We are seeking partners interested in licensing and distribution to bring this technology into every industry and jurisdiction. Contact our partnerships team to learn more.

The Prefacto™ Advantage: Elevate Your Operations

Without Prefacto, tokens issued on a blockchain trade freely between any address on that blockchain network.

Using our patented Prefacto technology, tokens transactions can be subject to validators, whitelists, or any off-chain data source.

Simplified Asset Tokenization

Define the assets you want to tokenize and set the parameters for your market. Prefacto™ supports various asset classes and token standards including security tokens, stablecoins, and central bank digital currencies.

Compliance Across Jurisdictions

By adhering to global standards of cybersecurity, privacy, compliance, and identity, we empower you to transform compliance challenges into market opportunities

Future-Proof Financial Transactions

Prefacto™ technology takes a forward-looking approach to ensure businesses are equipped to adapt to the ever-evolving landscape of compliance, risk, privacy, and security.

Streamlined Compliance Process

We don’t just offer a product; we offer a license to innovation. Prefacto™ allows you to integrate blockchain transactions requests into your existing compliance, risk, KYC, and IAM systems.

Scalable Secondary Transfer Processing

Leverage our patented Prefacto™ architecture for nearly limitless decentralized trade volumes at a minimal cost on any public or private blockchain network.

Discover Prefacto™

Our patented technology weaves blockchain transactions into your core systems seamlessly, ensuring compliance and enhancing user experience.