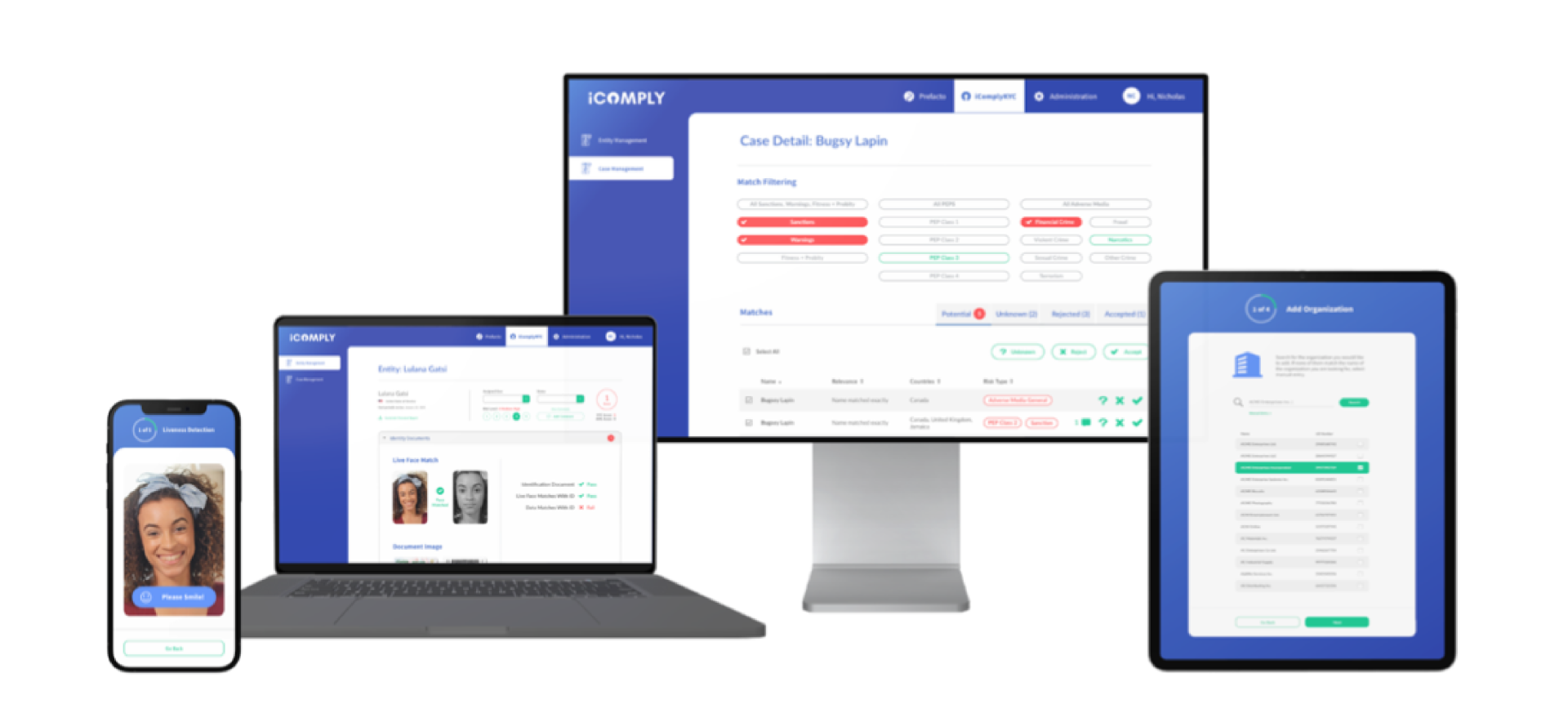

KYB Perfected: Reinventing Corporate Onboarding

Streamline your business client onboarding with swift and secure identity verification. Gain a 360-degree view of risk in real-time.

Complexities of Corporate Onboarding: Navigating Verification & Fraud Risks

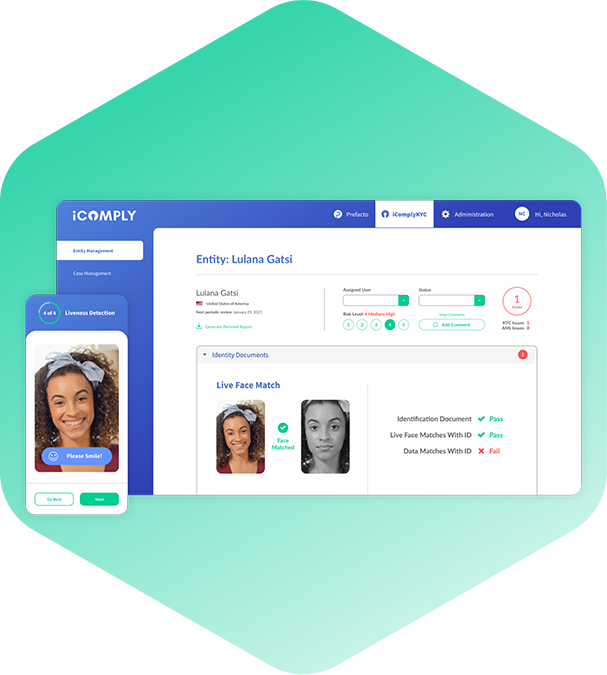

Our Pioneering Approach: Step into a new era of onboarding with iComply. Our platform not only streamlines but strengthens every facet of the process. With rapid business identity verification and in-depth risk assessments, you’re shielded against the pitfalls of the traditional approach. And, by integrating affiliate-validated KYC and KYB data collection, you gain a 360-degree view of every client, fostering trust and ensuring due diligence.

How Business and Entity Verification Works

A systematic and thorough process is essential for business and entity verification. iComply ensures this process is efficient and secure:

Define the Scope

Determine the necessary information for verification.

Gather Information

Collect information from various reliable sources.

Verify Accuracy

Use multiple methods to confirm the authenticity of information.

Evaluate Information

Assess the gathered data against defined criteria and standards.

Document the Process

Maintain comprehensive records of verification steps and results.

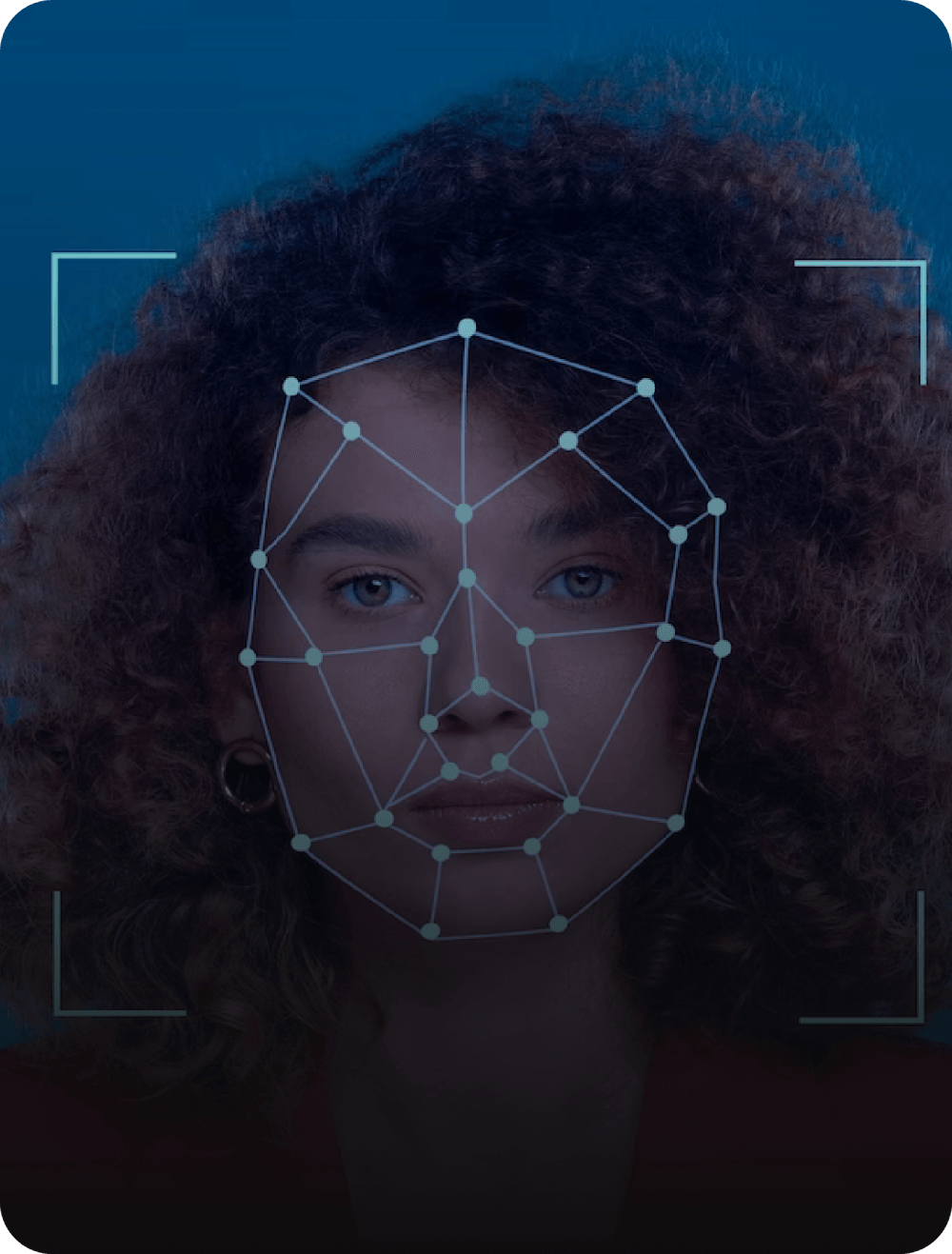

Image Comparison

Compare an image of the identity document with a government-issued reference image to ensure authenticity.

Why Choose iComplyKYC™ for

Corporate Onboarding

What Makes iComply’s Corporate

Verification Solution Stand Out?

Mitigate risks and expedite your corporate onboarding process with iComply:

Efficient Onboarding

Reduce time spent on manual onboarding processes.

Comprehensive Verification

Perform thorough checks using our expansive business database.

Enhanced Data Security

Ensure top-tier data security for your corporate onboarding.

Proof of Verification

Keep detailed records with proof of each verification.

Automated Monitoring

Stay updated with our automated monitoring processes.

iComply’s Document Verification Solution Focuses On Minimizing Risks And Maximizing Efficiency

Our solution streamlines the corporate onboarding process by performing thorough business verifications in real-time. Leveraging advanced AI technologies and human intelligence, we swiftly identify potential risks and provide highly accurate results.

Interested in exploring our other modules?

Getting Started With iComplyKYC™

Enhance your document verification process with iComply.