AML: Comprehensive Money Laundering Defense

Unearth potential risks associated with your customers using state-of-the-art Anti-Money Laundering (AML) tools.

Guarding Against the Silent Threat: Money Laundering in Modern Finance

The financial landscape is fraught with hidden perils. Every transaction, every customer relationship brings with it the shadow of potential money laundering – a silent, pervasive threat that can undermine trust, inflict severe penalties, and tarnish reputations irrevocably.

The iComply Advantage

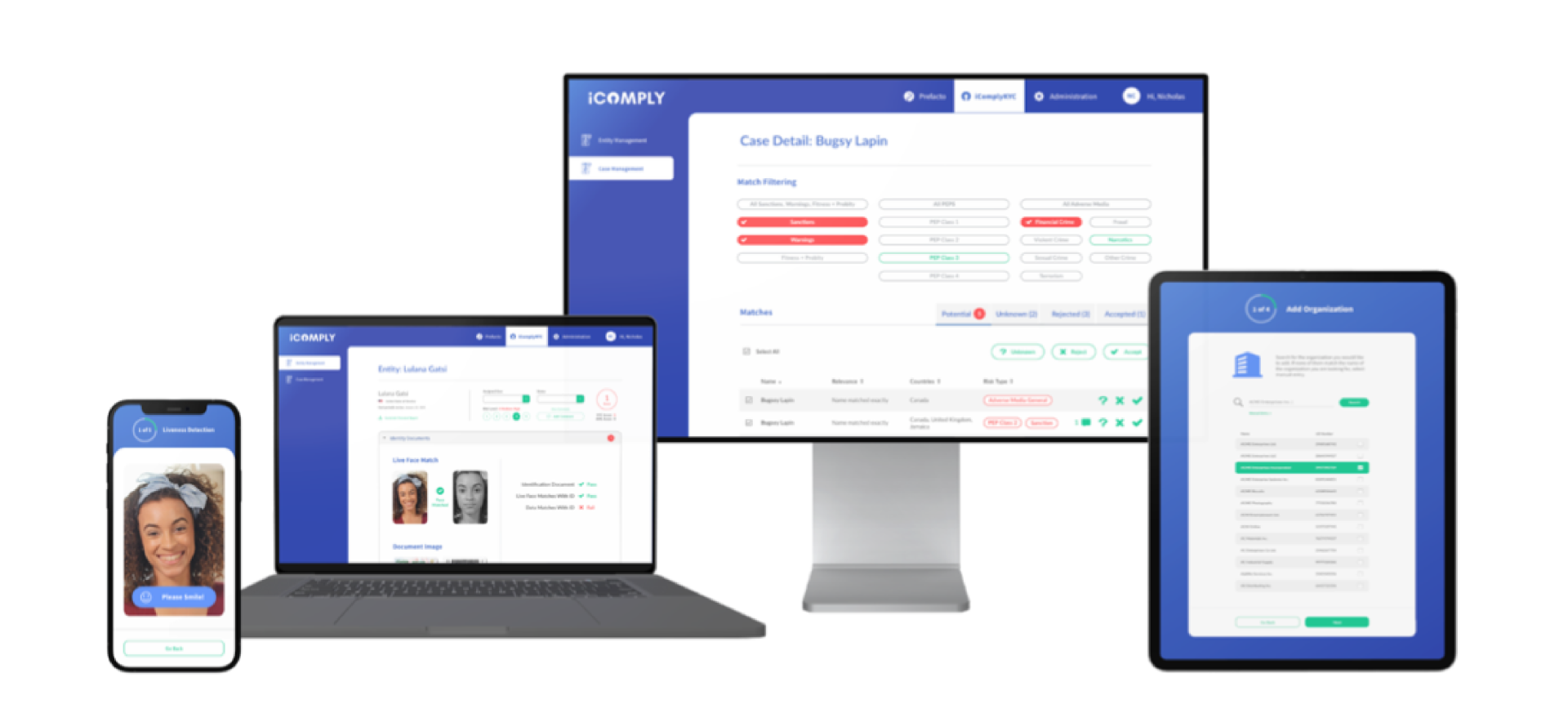

Introducing AML Risk Screening by iComply. Transcending traditional measures, we provide businesses an astute, technologically advanced defense against money laundering. By meticulously cross-referencing against global sanctions, watchlists, and adverse media databases from industry stalwarts like OFAC, FATF, and HMT, we offer unparalleled assurance and peace of mind.

Why Choose iComplyKYC™ for

AML Risk Screening

What Makes iComply’s AML

Screening Solution Stand Out?

Protect your business from AML compliance fines by understanding the risks associated with your customers.

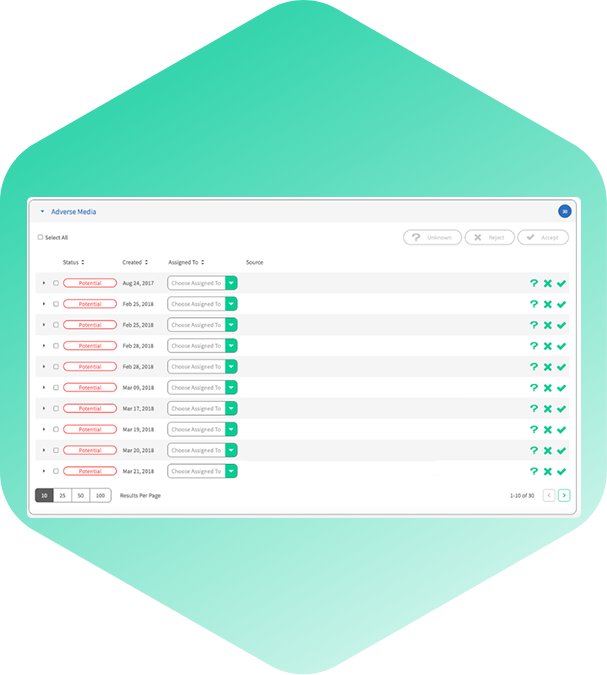

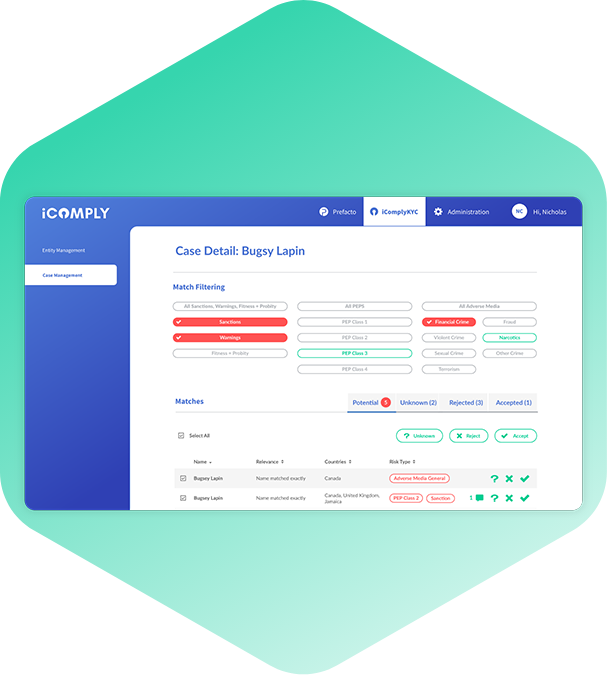

Interactive User Interface

Navigate effortlessly with our easy-to-use platform.

Screening within Seconds

Quick and efficient screening for immediate results.

Access to Extensive Datasets

Utilize our access to 1700+ global databases for in-depth screening.

Enhanced Data Security

Rest assured with our top-notch data security measures.

Proof of Screening

Maintain comprehensive records with proof of each screening.

Fully Automated Monitoring

Keep up-to-date with our automated monitoring processes.

iComply’s AML Solution Reduces False Positives By Utilising Multiple Ai Models

Our AML solution performs individual and business screening against global AML databases in real-time. We leverage advanced AI technologies and human intelligence to identify high-risk entities and deliver highly accurate results.

Looking to explore our other modules?

Getting Started With iComplyKYC™

Begin your journey with us and elevate your AML risk screening process.