Our innovative solution are recognized by

Mastering the Compliance Maze

The Challenge: In today’s intricate regulatory landscape, businesses require agile, trustworthy solutions for their KYC, KYB, and AML obligations, aiming to remain compliant without hampering user experience.

The Solution: Experience our platform’s transformative capabilities. Beyond the comprehensive modular approach, we empower businesses with unmatched benefits:

Hassle-Free Integration: Seamlessly embed our easily-installed widget into your existing systems, ensuring a fluid transition to enhanced compliance measures.

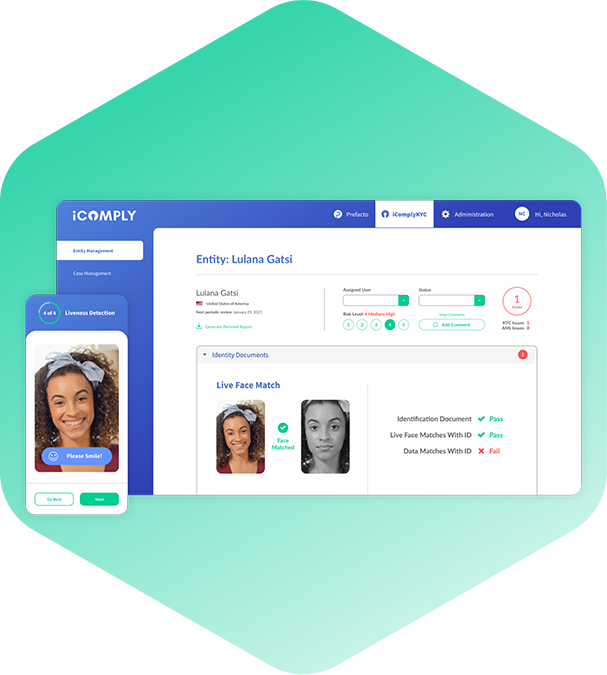

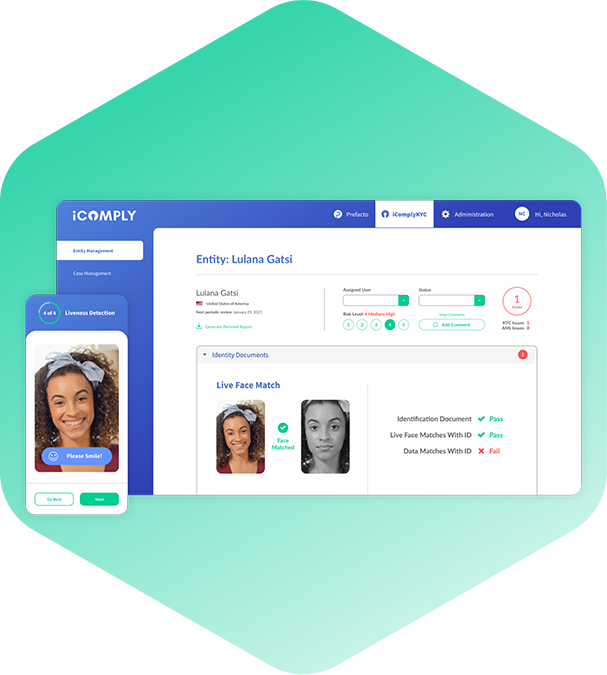

Universal Accessibility: With dedicated web and mobile apps, facilitate compliance checks anytime, anywhere, ensuring uninterrupted business operations.

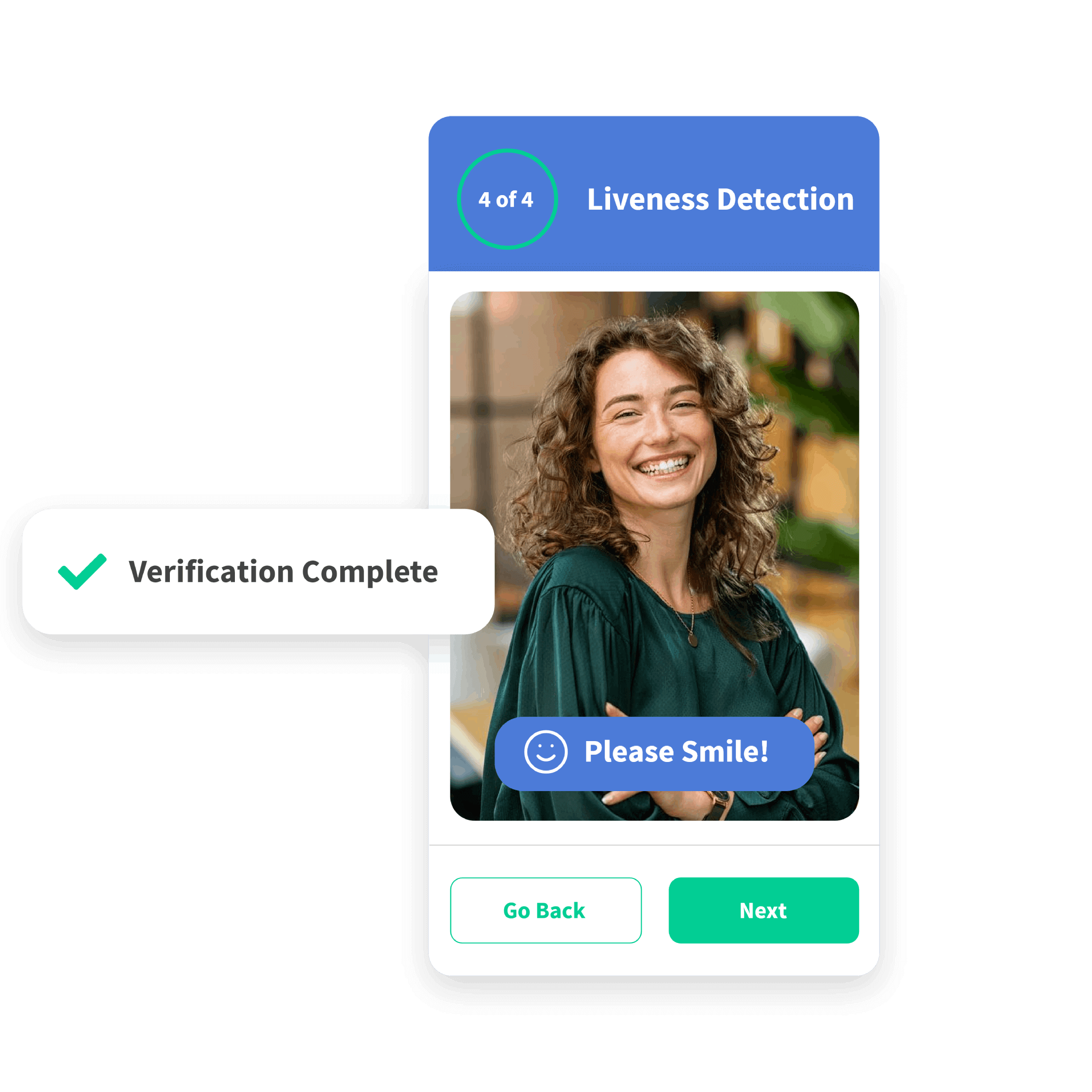

Unyielding Authentication: Our liveness test ensures the authenticity of user interactions, greatly diminishing the risk of fraud.

User-Centric Onboarding: Designed with users in mind, our platform simplifies and accelerates the onboarding process, enhancing user satisfaction and retention.

Experience the future of compliance. Book a demo with iComplyKYC™ today

Modules

KYC (Know Your Customer): iComplyKYC™’s KYC module ensures swift and secure identification and verification of your customers. Our solution streamlines the customer due diligence process, helping you mitigate risk and stay compliant with ease.

KYB (Know Your Business): iComplyKYC™’s KYB module helps you verify the authenticity of business entities and corporate structures. Our sophisticated algorithm checks against global business registries, ensuring comprehensive and accurate verification.

AML (Anti-Money Laundering): Our AML module simplifies compliance with anti-money laundering regulations. With features like ongoing monitoring, risk scoring, and sanctions screening, iComplyKYC™’s AML solution is designed to protect your business against financial crime.

Module Showcase: Your Compliance Toolkit

Application & Data Capture

Capture, authenticate, ecrypt customer data

Identity Verification

Facial recognition, liveness, live video

Custimer Due Deligence

3rd party fraud, PEP, sanctions screening

Workflow Automation

Automate, escalate, or assign tasks

Disclosure & Consent

Ensure privacy and consent

Customization

DD questions, document collection, workflows

Why chose iComplyKYC™ to Discover the

iComplyKYC™ Advantage for KYC

iComplyKYC™ Use Cases Unveiled

Frequently Asked Question

Get answers to your questions and learn more about how iComply can support your business

Support

Need help? Our support team is available 24/7 to assist you with any issues or questions you may have.