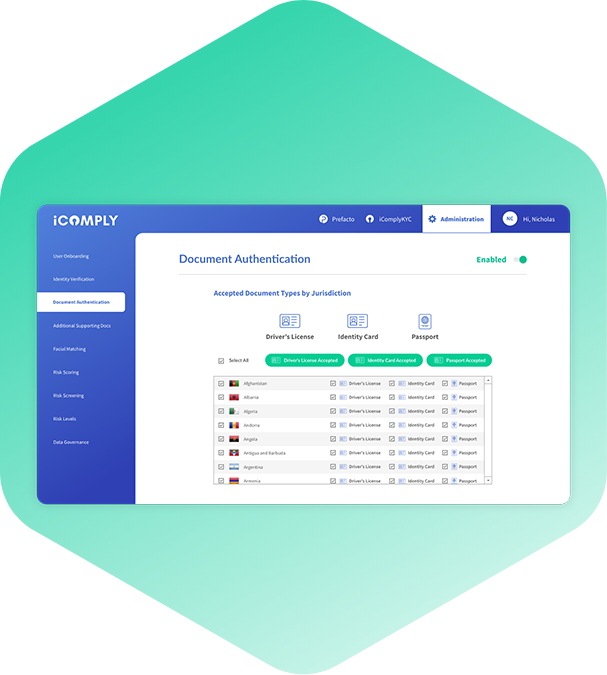

AI-Powered Document Verification

Leverage the speed and precision of artificial intelligence to securely verify identity documents. Guarantee accurate individual recognition vital for financial operations and controlled access.

Navigating Document Verification in the Digital Age

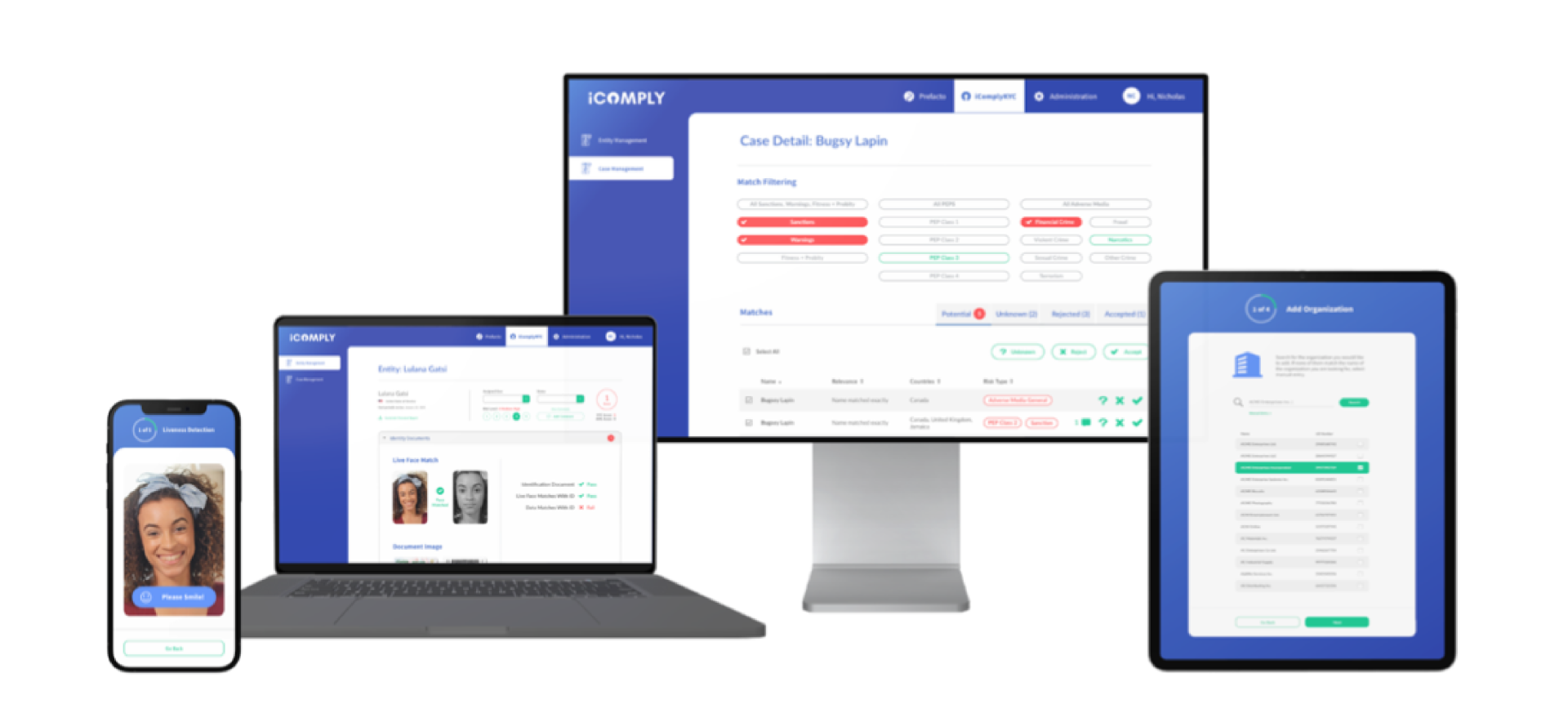

iComply’s Assurance: Through advanced technology, iComply transforms this task into a quick, accurate, and secure process, optimizing both safety and operational efficiency across various verification domains.

How KYC Document Verification Works

iComplyKYC™‘s KYC Document verification process is comprehensive and systematic. It includes defining the verification scope, gathering information from a variety of sources, verifying the accuracy of the information through multiple methods, evaluating the information against defined criteria, and documenting the entire verification process for future reference.

Edge Computing

Perform document authentication on the user device to improve prove, security, and reduce cost.

Electronic Verification

Utilize electronic chips or barcodes on identity documents for quick verification.

Optical Character Recognition

Leverage machine vision for data authentication, extraction, and validation.

Template Matching

Machine vision instantly analyzes size, placement of text, security features, and more for precise verification.

Database Checks

Cross-check information against global identity datasets and identity fraud watchlists for added security.

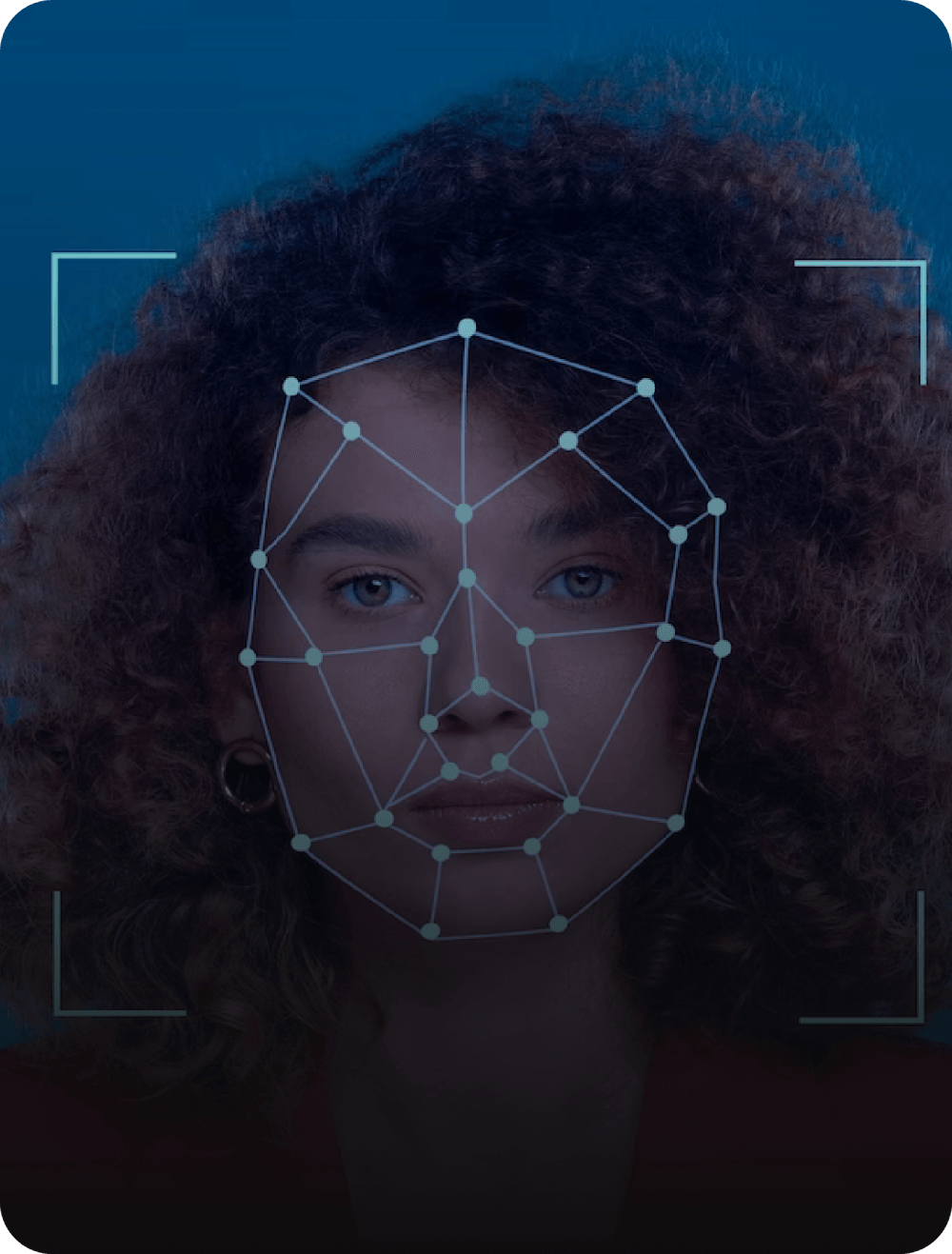

Image Comparison

Use the government-issued reference image to ensure authenticity for onboarding or re-authentication.

Why Choose iComplyKYC™ for

Document Verification

What Makes iComply’s Document

Verification Solution Stand Out?

Improve operational efficiency and security with iComply’s document verification solution:

Efficient Verification

Reduce time spent on manual verification processes.

Comprehensive Verification

Leverage diverse methods for thorough verification.

Enhanced Data Security

Ensure top-tier data security during your document verification.

Proof of Verification

Keep detailed records with proof of each verification.

Automated Monitoring

Stay updated with our automated monitoring processes.

iComply’s Document Verification Solution Focuses On Minimizing Risks And Maximizing Efficiency

Our solution streamlines the document verification process by conducting thorough checks in real-time. Leveraging advanced AI technologies and human intelligence, we quickly identify potential risks and provide highly accurate results.

Interested in exploring our other modules?

Getting Started With iComplyKYC™

Enhance your document verification process with iComply.