Streamlining Identity Verification with Advanced Biometrics and Liveness Detection

With identity fraud on the rise, organizations require robust, secure, and efficient tools for user authentication. iComplyKYC™ ‘s biometrics and liveness detection module offers a cutting-edge solution, minimizing risks and ensuring seamless, user-friendly experiences.

Digital Identities: Navigating Today’s Verification Maze

Modern Menace: The age of digitalization brings unprecedented challenges in identity verification. As fraudsters evolve, businesses and their customers face amplified threats. Conventional verification methods lag behind, marked by delays, inefficiencies, and heightened vulnerability.

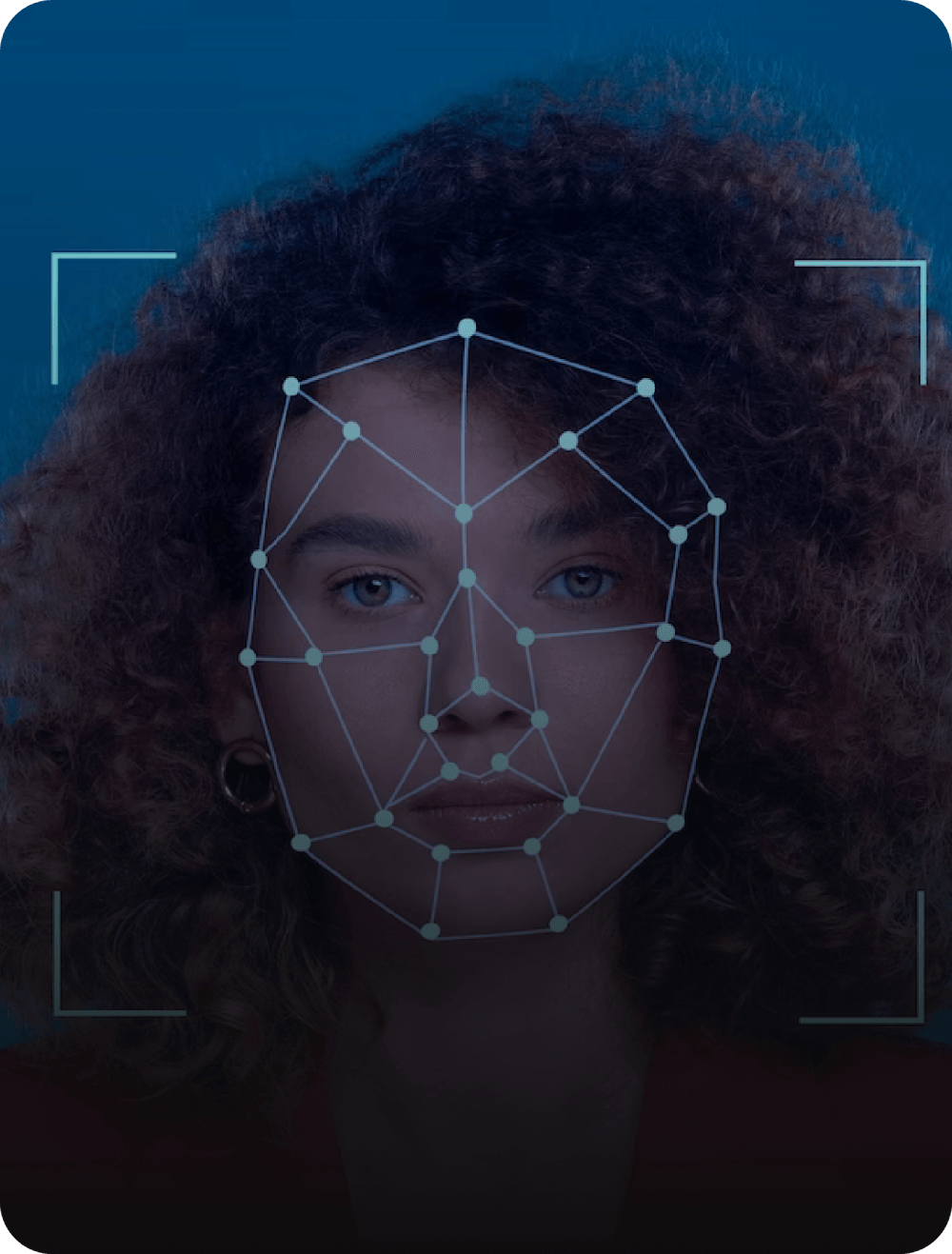

Innovation at iComplyKYC™: Enter our state-of-the-art biometrics and liveness detection module. Harnessing next-gen technologies, we champion secure, streamlined, and user-centric authentication. Navigating Today’s Verification Maze. Beyond these, our liveness detection stands as a vanguard, affirming the authentic presence of an active user.

How Biometrics and Liveness Works

Our biometrics and liveness detection module harnesses cutting-edge technology to verify and authenticate user identity:

Users are enrolled through multi-factor authentication, which includes unique physiological or behavioral modalities.

During each sign-in, users complete a quick selfie login—a secure and convenient method of identity verification.

Our liveness detection technology validates the genuine presence of a living user, distinguishing actual users from audio recordings or static images.

We conduct ongoing KYC of existing customers, keeping customer data accurate and up-to-date.

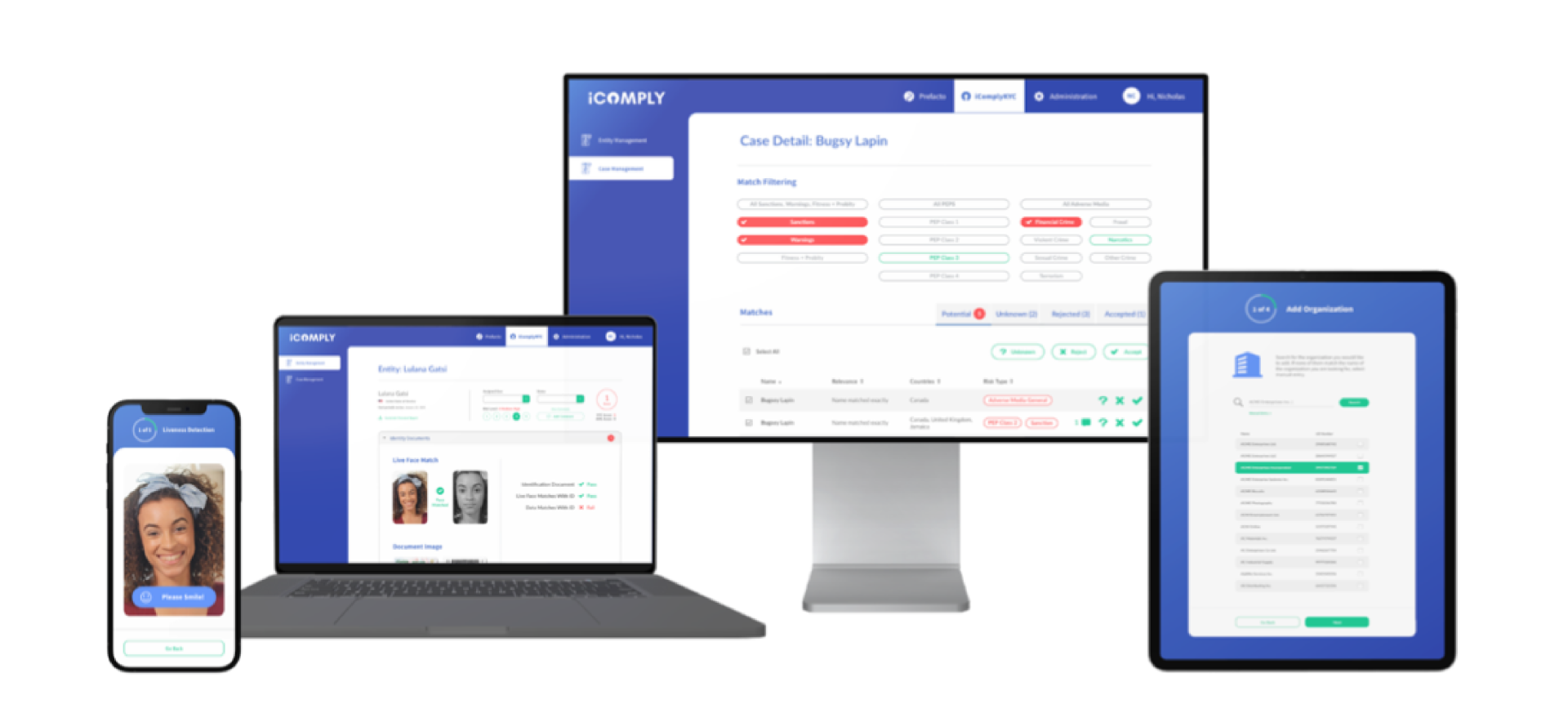

Getting Started With iComplyKYC™

Embark on a journey towards streamlined, secure, and user-friendly identity verification. To get started with iComplyKYC™, simply sign up and follow the guided setup process. Our support team is ready to assist with any queries you may have along the way.

Ready to revolutionize your identity verification process? Book a demo today and discover how iComplyKYC™‘s biometrics and liveness detection module can benefit your organization.

Why Choose iComplyKYC™ for

Biometrics & Liveness

Efficiency Unleashed: Revolutionizing Compliance with iComplyKYC™

iComplyKYC™ redefines compliance management through advanced edge computing and artificial intelligence. It introduces a comprehensive suite of tools and modules, meticulously designed to bolster user data protection while streamlining secure identity verification.

Advanced Modules for Authentication Excellence

Defending Authenticity: