Blogs

Assessing Customer Risk with Automated KYC and AML Software

With financial crime, fraud, and money laundering quickly taking precedence as some of the most aggressively expanding forms of crime across the globe, having a risk-based approach to monitoring your current customer base, as well as verifying the identities of new...

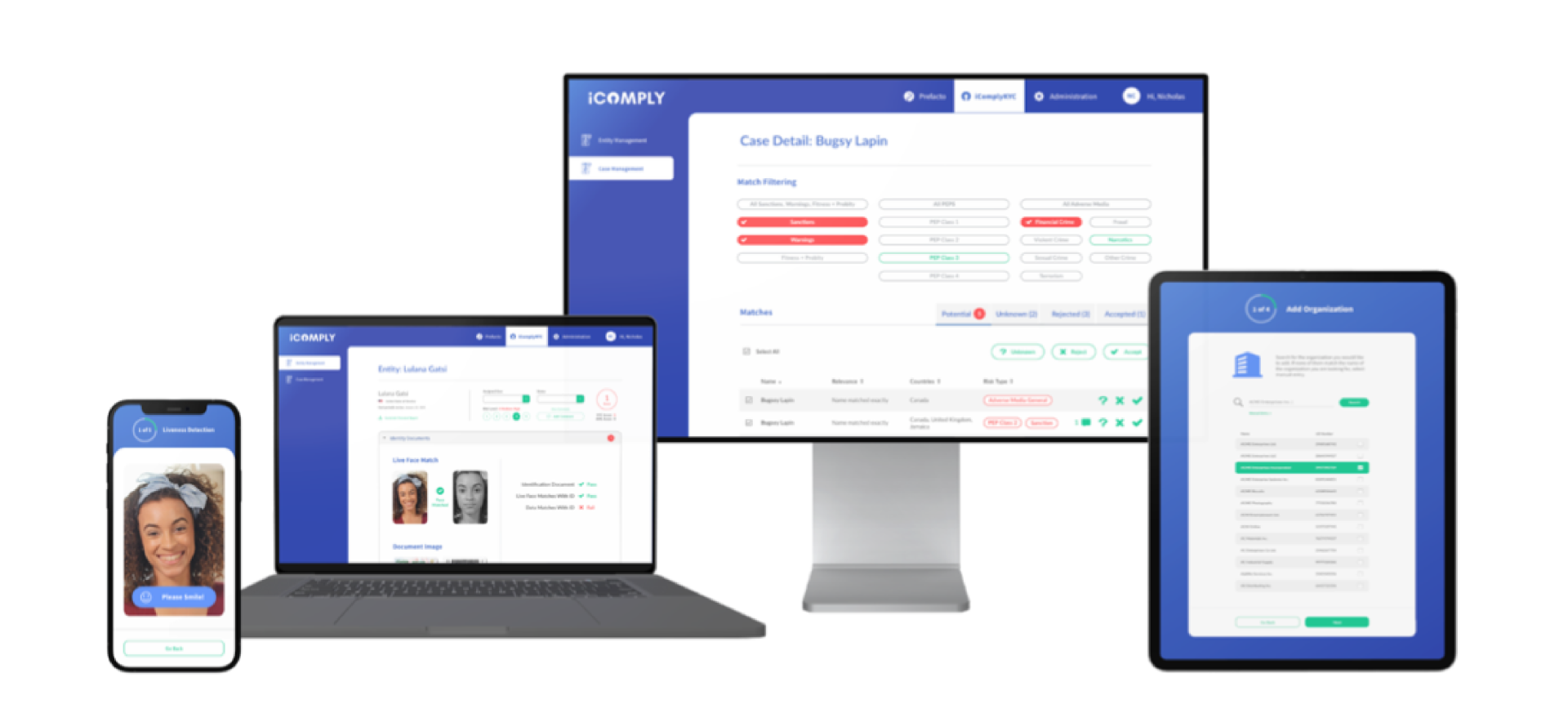

KYC for Banking – Made Simple with iComply

Is your banking institution set up for success and compliance in 2023? With the financial and digital asset markets experiencing a tumultuous time after the extreme fluctuations faced during the peak of COVID-19, there’s never been a more important time to double down...

How to Spot Fraudulent Users with KYC Protocols

While we often speak about the many risks and crimes that Know Your Customer (KYC) protocols help to circumvent (the reactive approach), the cybersecurity industry can sometimes forget to highlight the specific ways KYC software and practices offer protection (the...

Eye On Compliance in 2023: Top KYC Trends

As Q2 of 2023 ramps up, the compliance industry continues to face a fast-paced environment of global changes and challenges when implementing protective measures against fraud, money laundering (AML), and other forms of financial crime (FinCrime). 2022 brought no...

Digital Identities in 2023: Trends and Updates

With the first months of 2023 already showing uncertainty in both financial and digital markets (re: Silicon Valley Bank and Credit Suisse), business leaders are looking for ways to stay on top of evolving trends and patterns of risks to mitigate the harm caused by...

Spotlight On: The Role of AML in Ending Human Trafficking

Human trafficking and modern slavery remain two of the most challenging humanitarian issues for international legislators and law enforcement agencies to resolve—due in large part to the the level of difficulty to uncover hidden channels and illegal measures that...

Regtech Terms 101: Definitions Made Simple

If you're in the process of implementing or revising your money laundering and financial crime protocols, you’ve no doubt come across the many terms and acronyms associated with financial regulations. As fintech and related financial crime mandates continue to evolve,...

What Triggers an AML Investigation?

Money laundering and financial fraud are two of the biggest risks facing businesses and institutions worldwide, with an estimated USD $800 million to $2 billion laundered annually. To combat this, global legislators such as FinCEN, FINTRAC, and various European...

Business Continuity After Fraud: How to Recover and Build a Foundation for Success

Has your business recently faced difficulties due to a fraudster, money laundering, or other criminal activity? Whether your experience stems from a failure to comply with existing AML legislation or from overlooked vulnerabilities in your current KYC or KYB...

Reviewing Customer Risk Profiles After Onboarding

As we ease into a new year, there’s never been a better time to review your organization's AML and KYC protocols to ensure you are as protected as possible. Criminal activities continue to grow...

Factors of Conducting Enhanced Due Diligence

Are your KYC protocols and practices set up for success in 2023? As we settle into the new year and face the ever-evolving world of online business, now more than ever before companies and financial...

Reviewing the Travel Rule for Virtual Assets: What You Need to Know

With virtual assets and decentralized financial exchanges continuing to make headlines in 2022, many countries are aiming to implement more compliance advancements in the coming years. Reviewing the...

Protect and Streamline Your Business with iComply’s EDD and KYC Software

Does your organization have adequate safeguards in place to circumvent fraud and uphold evolving money laundering legislation? Know Your Customer (KYC) and Customer Due Diligence (CDD) protocols are...

Corporate Due Diligence: Putting the KYB in KYC

Do you know who you’re doing business with? Corporate due diligence, Know Your Business (KYB), and Know Your Customer (KYC) protocols are essential safeguards against money laundering, fraud, and...

Uncovering the Risks of Synthetic Identities

Meet “Joe Smith”, your suspiciously-good-on-paper prospective client applying for a line of credit. While many of Joe’s details seem to be tied to real documents like a valid Social Insurance or...

Stepping Up Your AML Practices in 2023

As we ease into 2023 and reflect on the ever-evolving world of digital security, there’s no denying that fraudsters have become incredibly advanced in their approach—an estimated 90% of money...

Protecting Digital Assets with KYC

Are your KYC protocols set up to protect your customers and your digital assets? With the digital world constantly evolving and new assets entering the market, ensuring that your due diligence and...

Common Challenges Facing KYC Protocols

Do you have the right processes and protocols in place to protect against fraud, money laundering, and the many other risks that come with operating in today’s market? Know Your Customer and...

How KYC Protocols Build Customer Trust

If you’ve followed along on any of our previous KYC blogs or are a subscriber of our Regwatch newsletter, you know just how important it is to stay on top of evolving KYC, AML, CFT, and CDD...

Taking a Closer Look at Enhanced Due Diligence

Enhanced Due Diligence (EDD) is one of the best ways to protect your business, as well as your customers, against the risks associated with fraudulent activities, money laundering, terrorist...

How Does Edge Computing Assist with KYC?

As one of the most formidable technical features available on the market, edge computing gives KYC and AML solutions such as iComplyKYC a huge advantage when it comes to ensuring the privacy and...

Legal Agreements