Blogs

The Importance of Edge Computing for Compliance in KYC and AML Software

Why Edge Computing is Important for Compliance 1. Enhanced Security Edge computing processes data closer to where it is generated, reducing the need to transmit sensitive information over potentially insecure networks. This...

Interview with Matthew Unger, CEO of iComply, on Financial Crime Prevention and Deep Fake Prevention

Introduction In this interview, we speak with Matthew Unger, the CEO of iComply, about the critical aspects of financial crime prevention and the emerging threat of deep fakes. Matthew shares his insights on how iComply is...

The Comprehensive Guide to Adverse Media Monitoring

In the realm of compliance and risk management, adverse media monitoring is a critical tool. It involves systematically tracking and analyzing negative news coverage related to individuals or entities to identify potential risks....

The Critical Role of Global Sanctions Screening in AML Compliance

The Critical Role of Global Sanctions Screening in AML Compliance

The Essentials of PEP (Politically Exposed Persons) Screening

How to Guide for Identity Data Validation

Identity data validation is a crucial process for financial institutions, fintech companies, and other regulated entities. It involves verifying the accuracy and authenticity of identity information provided by customers during onboarding and ongoing monitoring....

Understanding Enhanced Due Diligence (EDD): A Deep Dive

What is Enhanced Due Diligence (EDD)? Enhanced Due Diligence (EDD) is a crucial component of compliance programs within financial institutions, fintech companies, and other regulated entities. Unlike standard due diligence, EDD involves a more thorough investigation...

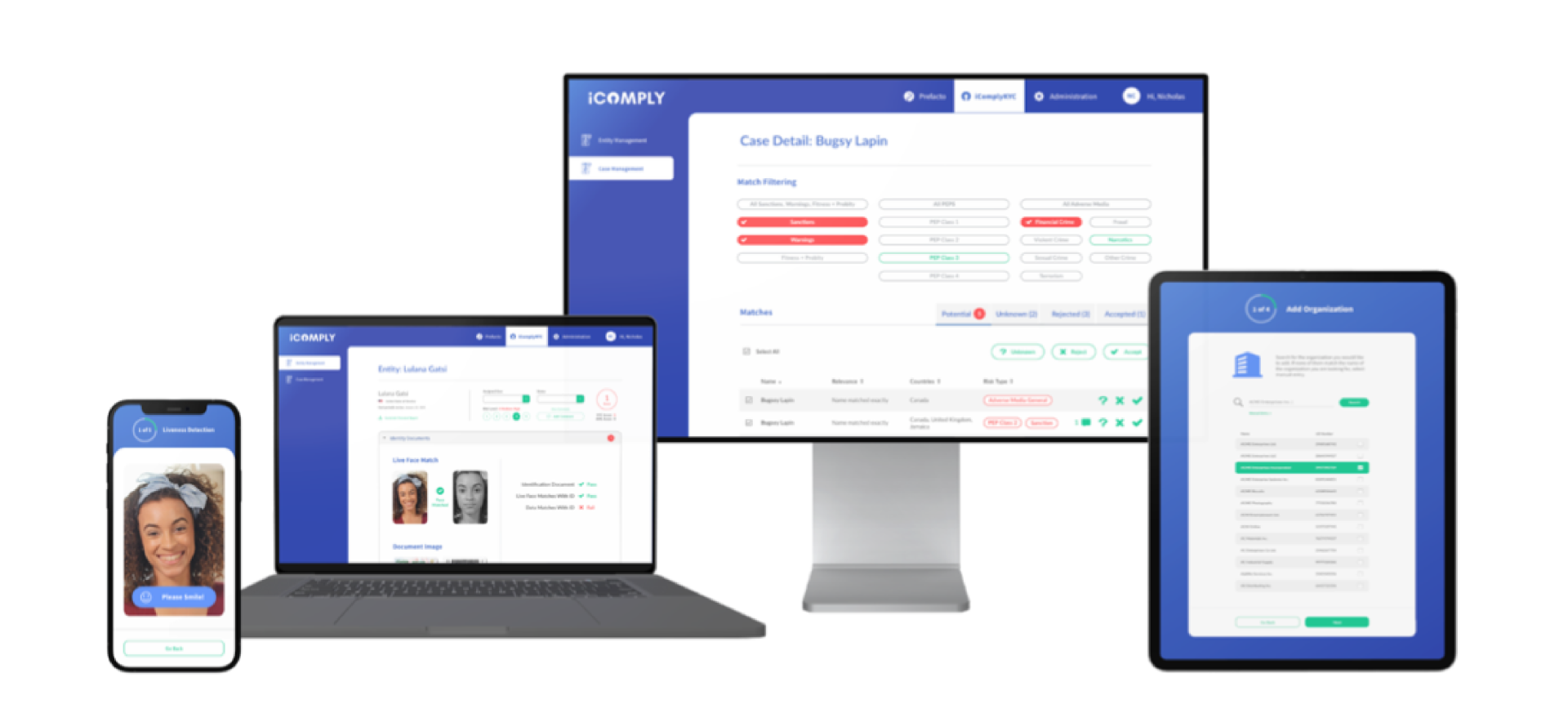

How to Integrate New Compliance Technologies: A Guide to KYC Integration

Integrating new compliance technologies into your existing systems can seem daunting, but with a structured approach, it becomes manageable and highly beneficial. This guide outlines the steps for integrating compliance technologies, focusing on leveraging the...

How to Guide for Identity Data Validation

Identity data validation is a crucial process for financial institutions, fintech companies, and other regulated entities. It involves verifying the accuracy and authenticity of identity information...

Understanding Enhanced Due Diligence (EDD): A Deep Dive

What is Enhanced Due Diligence (EDD)? Enhanced Due Diligence (EDD) is a crucial component of compliance programs within financial institutions, fintech companies, and other regulated entities....

How to Integrate New Compliance Technologies: A Guide to KYC Integration

Integrating new compliance technologies into your existing systems can seem daunting, but with a structured approach, it becomes manageable and highly beneficial. This guide outlines the steps for...

The Role of Edge-Computing in Compliance

Edge computing is transforming various industries by bringing data processing closer to the source of data generation. In the realm of compliance, particularly in financial services, edge computing...

Navigating Global Compliance Challenges: An Interview with Matthew Unger, CEO of iComply

Interviewer: Hi Matthew, thank you for joining us today. Could you start by introducing yourself and explaining your role at iComply? Matthew Unger: Sure, I’m Matthew Unger, the CEO and founder of...

Corporate KYC Compliance: Ensuring Business Integrity and Security

Understanding Corporate KYC Compliance In today’s increasingly regulated business environment, Corporate KYC (Know Your Customer) compliance is more crucial than ever. This process involves...

Real-Time AML Checks: Enhancing Compliance and Security in Financial Transactions

In today’s digital world, financial crimes are evolving rapidly, challenging institutions to innovate their protective measures. Traditional methods of detecting money laundering fall short, making...

The Ultimate Checklist for Choosing KYB Verification Software

Choosing the right Know Your Business (KYB) verification software is a critical decision for compliance managers, analysts, administrative leads, CFOs, and COOs across various industries including...

How to Streamline Your KYB Onboarding Process: A Step-by-Step Guide

In the fast-paced world of business, ensuring a smooth and efficient onboarding process for corporate clients is crucial. Know Your Business (KYB) checks are essential to verify the legitimacy of...

Top 7 Anti-Money Laundering Solutions to Combat Financial Crime in 2024

As financial crimes grow more sophisticated, the need for effective Anti-Money Laundering (AML) solutions becomes critical. Money laundering not only threatens financial systems but also carries...

The Power of AML Monitoring Tools: Strengthening Compliance and Security

In the high-stakes world of finance, the battle against money laundering and financial crimes is relentless. For businesses, the threat of illicit activities isn't just a regulatory concern—it's a...

Top 10 Features of Effective AML Compliance Software: An Expanded Guide

In today's digital age, the threat of money laundering and financial crimes is more significant than ever. Financial institutions and businesses must be equipped with robust Anti-Money Laundering...