Blogs

Digital Document Verification: Techniques for Preventing Fraud

Digital document verification is a critical component in the fight against fraud. By leveraging advanced technologies and robust processes, businesses can ensure the authenticity of digital documents, enhancing security and...

ID Verification Apps: Enhancing Security and User Experience

In today's digital landscape, ID verification apps play a crucial role in enhancing security and user experience. These apps are vital for businesses that need to authenticate identities quickly and accurately, ensuring...

Key Features of Digital Identity Verification Solutions

Online identity verification is an essential component of modern digital security. As cyber threats continue to evolve, robust identity verification solutions are necessary to protect sensitive information and maintain regulatory...

Enhanced Due Diligence (EDD): When and how to implement EDD for high-risk customers.

In the world of financial services, understanding your customers is crucial for maintaining a secure and compliant operation. While standard due diligence might be sufficient for most customers, high-risk customers require a more...

Customer Due Diligence (CDD): Importance and methods of CDD in preventing financial crimes.

In today’s financial landscape, Customer Due Diligence (CDD) is more crucial than ever. Financial institutions are under increasing pressure to know their customers, not just to comply with regulatory requirements but also to...

Steps in the KYC Process: Step-by-step guide to performing effective KYC checks.

Understanding Know Your Customer (KYC) regulations is essential for financial institutions worldwide. These regulations are designed to combat money laundering, terrorist financing, and other financial crimes by ensuring that...

KYC Regulations Overview: A detailed look at global KYC regulations and their impact on financial institutions.

Understanding Know Your Customer (KYC) regulations is essential for financial institutions worldwide. These regulations are designed to combat money laundering, terrorist financing, and other financial crimes by ensuring that...

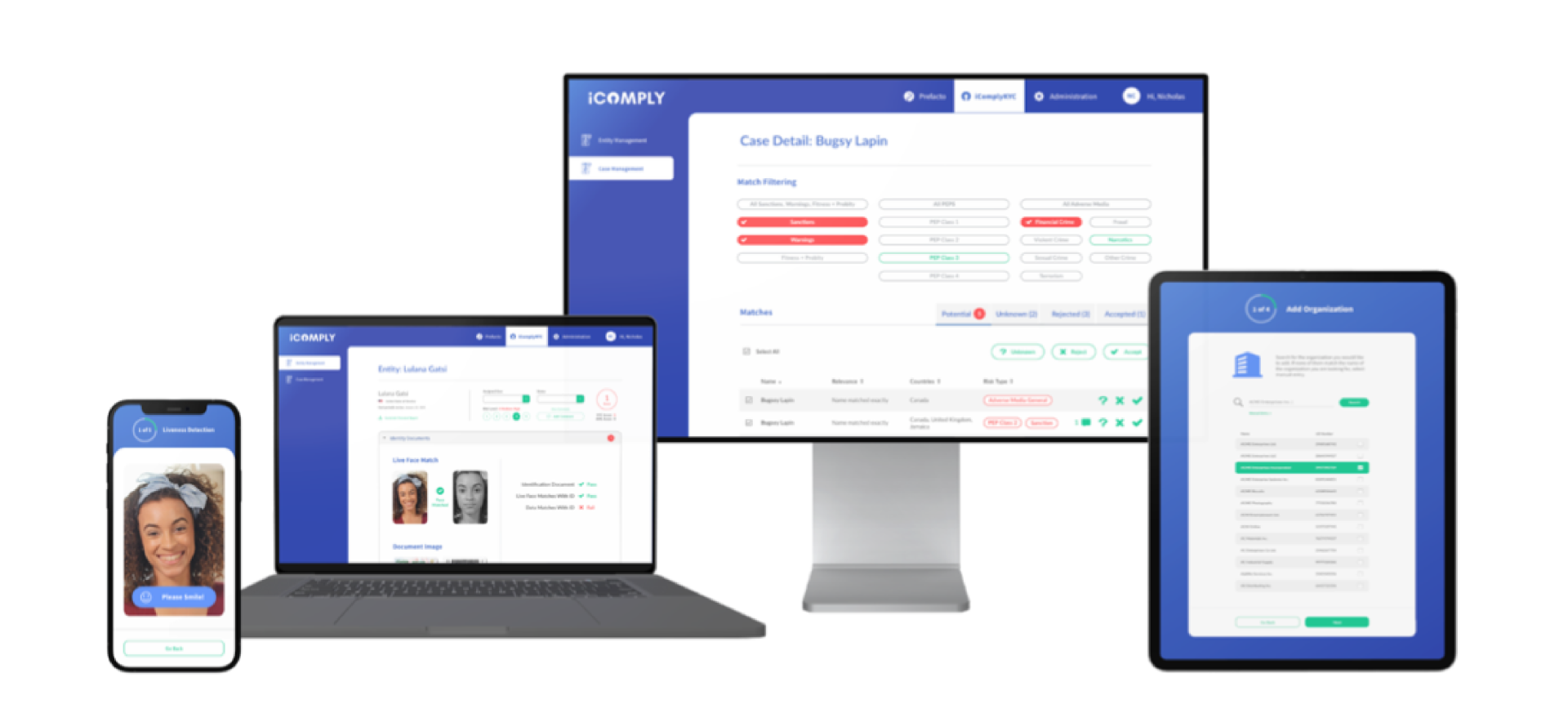

KYC Compliance Solutions: Ensuring Security and Regulatory Adherence in Financial Services

Navigating the complexities of KYC compliance can be challenging for financial institutions. With the ever-evolving regulatory landscape and the need to safeguard against fraud, having robust KYC solutions is essential. These...

Comprehensive Checklist for Implementing an Integrated Compliance Solution

In today’s rapidly evolving regulatory landscape, financial institutions and other regulated entities must implement robust compliance solutions to manage regulatory requirements effectively and reduce risks. An integrated...

Enhanced Due Diligence (EDD): When and how to implement EDD for high-risk customers.

In the world of financial services, understanding your customers is crucial for maintaining a secure and compliant operation. While standard due diligence...

Customer Due Diligence (CDD): Importance and methods of CDD in preventing financial crimes.

In today’s financial landscape, Customer Due Diligence (CDD) is more crucial than ever. Financial institutions are under increasing pressure to know their...

Steps in the KYC Process: Step-by-step guide to performing effective KYC checks.

Understanding Know Your Customer (KYC) regulations is essential for financial institutions worldwide. These regulations are designed to combat money...

KYC Regulations Overview: A detailed look at global KYC regulations and their impact on financial institutions.

Understanding Know Your Customer (KYC) regulations is essential for financial institutions worldwide. These regulations are designed to combat money...

KYC Compliance Solutions: Ensuring Security and Regulatory Adherence in Financial Services

Navigating the complexities of KYC compliance can be challenging for financial institutions. With the ever-evolving regulatory landscape and the need to...

Comprehensive Checklist for Implementing an Integrated Compliance Solution

In today’s rapidly evolving regulatory landscape, financial institutions and other regulated entities must implement robust compliance solutions to manage...

The Importance of Edge Computing for Compliance in KYC and AML Software

Why Edge Computing is Important for Compliance 1. Enhanced Security Edge computing processes data closer to where it is generated, reducing the need to...

Interview with Matthew Unger, CEO of iComply, on Financial Crime Prevention and Deep Fake Prevention

Introduction In this interview, we speak with Matthew Unger, the CEO of iComply, about the critical aspects of financial crime prevention and the emerging...

The Comprehensive Guide to Adverse Media Monitoring

In the realm of compliance and risk management, adverse media monitoring is a critical tool. It involves systematically tracking and analyzing negative news...

The Critical Role of Global Sanctions Screening in AML Compliance

The Critical Role of Global Sanctions Screening in AML Compliance

The Essentials of PEP (Politically Exposed Persons) Screening