Our innovative solutions are recognized by

Digital Compliance

Navigating the Maze Navigating compliance in the digital world brings significant challenges. Businesses grapple with shifting regulations, inefficient systems, and insufficient data control, resulting in costly mistakes, trust breaches, and wasted resources. Moreover, a lack of automation, instant settlement, and swift transferability often blocks efficient onboarding and risk management.

Pioneering the Future of Secure, Efficient Transactions

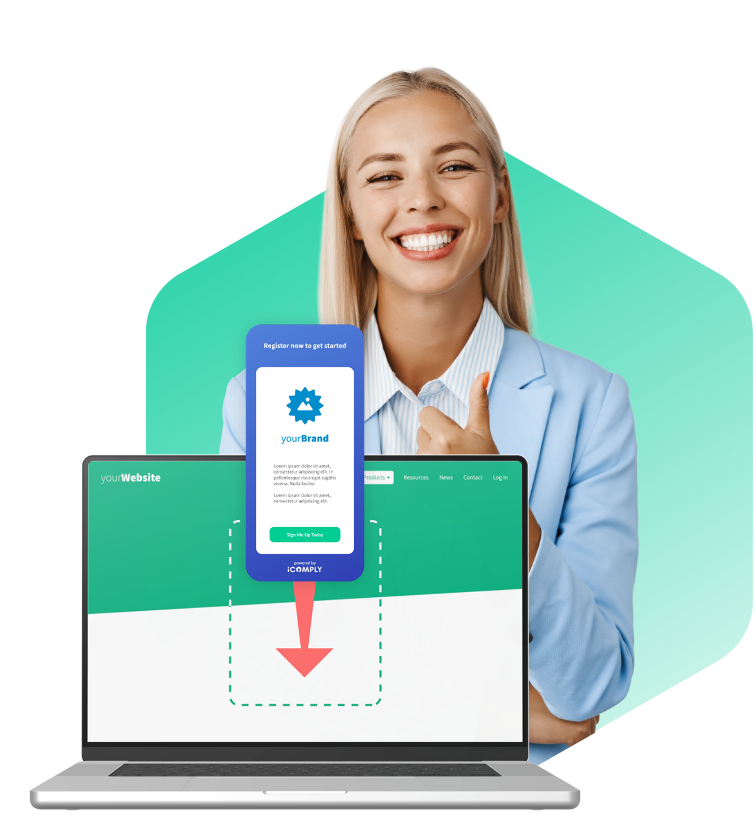

Our innovative platforms, including iComplyKYC™ and Prefacto™, are reshaping financial compliance. They streamline processes and ensure secure transactions, boasting features that support automation, digital security control, and improved transferability. With this high-ROI framework, businesses can concentrate on growth, leaving the complexities of compliance to us. We’re not just addressing compliance needs — we’re setting the new standard for digital transactions.”

Experience the iComply Advantage

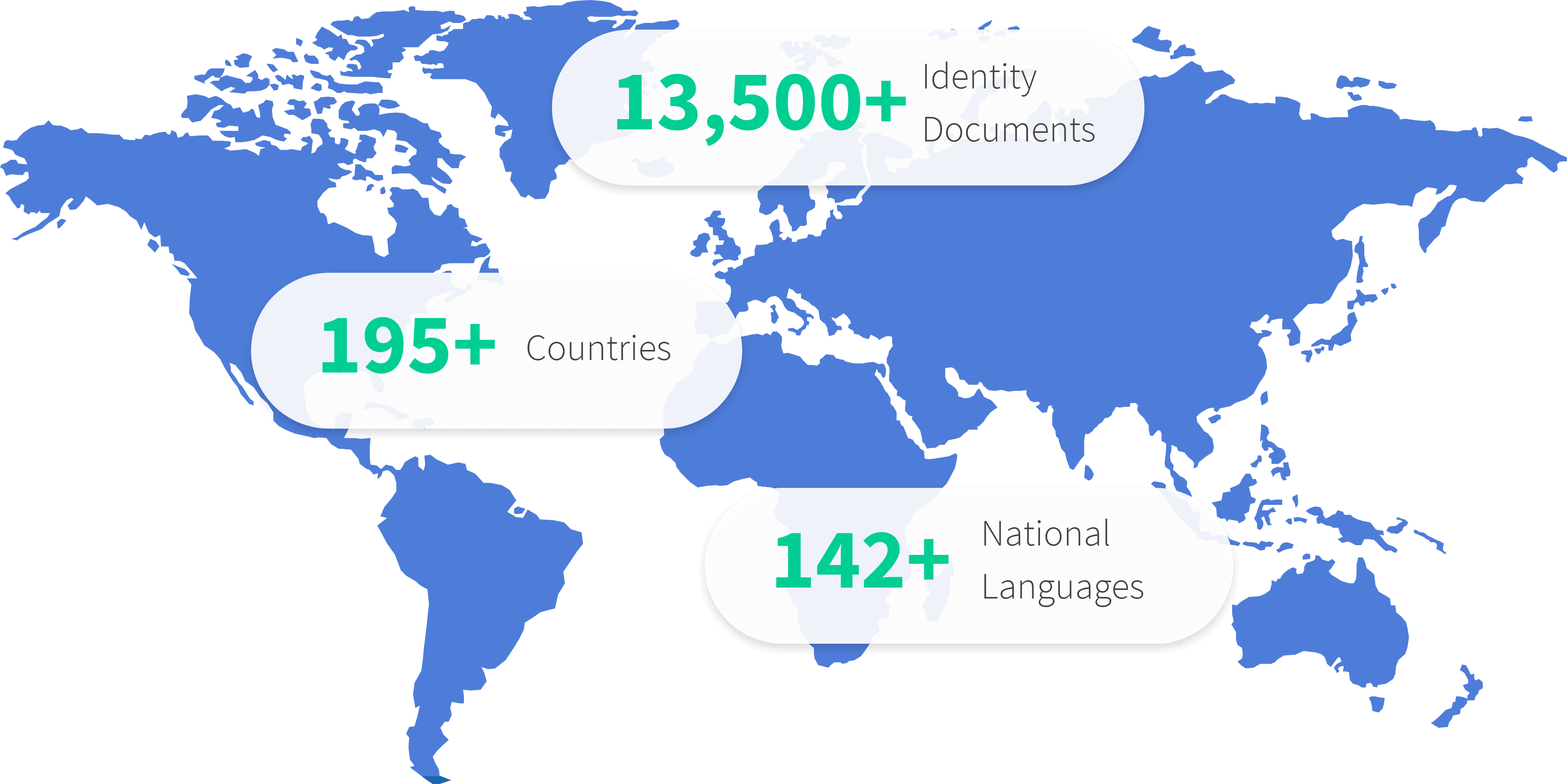

Unparalleled Reach

Gain confidence with our globally tailored compliance solutions for secure transaction

Automated Efficiency

Streamline compliance with automated KYC processes and pre-validation workflows

Flexible Solutions

Comprehensive suite of tools adapts to your needs to simplify regulatory requirements

Innovative Technologies

Navigate regulatory complexities with our cutting-edge solutions for a high ROI

Time-saving Processes

Our user-friendly Prefacto™ and iComplyKYC™ help you save valuable time and stay ahead in digital compliance

Transferability & Control

Facilitate asset transferability and maintain control over digital securities with our robust framework

iComplyKYC™: Advanced KYC & AML Compliance

Ensure robust compliance with iComplyKYC™. Our platform offers comprehensive automated checks—including exhaustive KYC, KYB, and AML screenings—to elevate your compliance process to be secure, accurate, efficient and adaptable to regulatory changes.

Prefacto™: The Path to Tokenization

Step into the next era of financial management with Prefacto™. This licensing program integrates regulatory compliance and innovative technology, offering seamless control over your digital assets. Experience smoother transactions and fortified security in the blockchain sphere with Prefacto™.

iComplyKYC™: The Modular Solution for Comprehensive Compliance

AML Risk Screening

Comprehensive screening for Adverse Media, PEPs, and Sanctions

Corporate Onboarding

Streamlined, efficient onboarding for legal entities

Document Verification

Robust verification of key documents

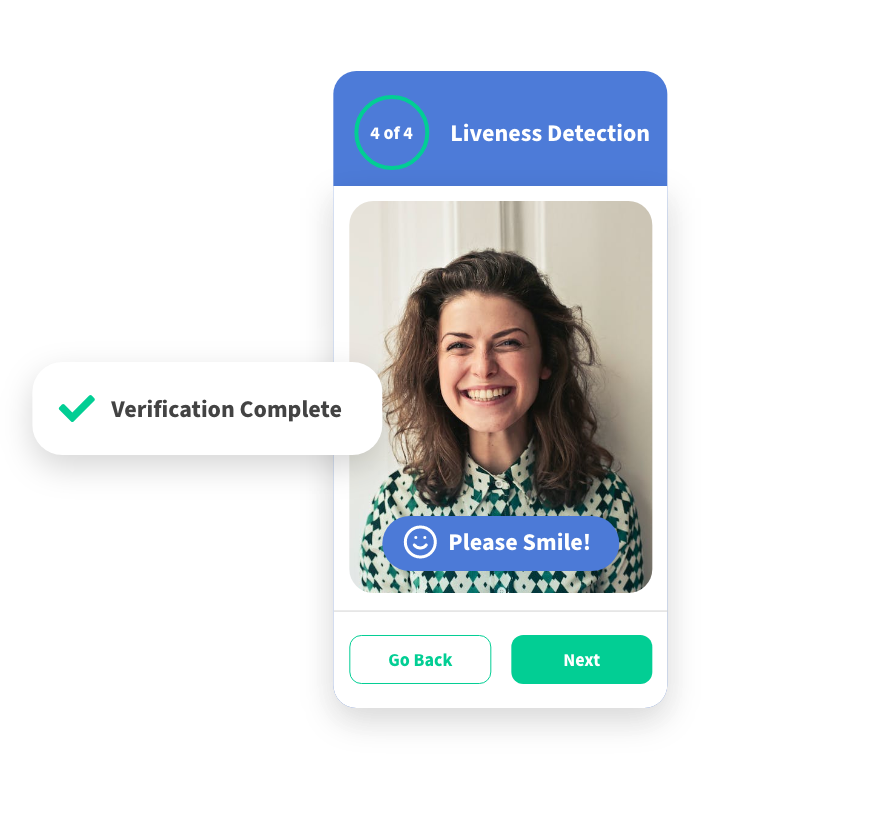

Biometrics & Liveness

Advanced biometric and liveness verification for enhanced security

Identity Verification

Comprehensive and reliable identity verification process

iComply’s Universal Impact

Spanning a diverse range of sectors, iComply empowers organizations to manage their digital transactions with unmatched efficiency and security.

Credit Unions

Financial Services

Fintech

Real Estate

Accounting Firms

Legal

Crypto

Insurance

General Industries

Global Coverage

Delivering unmatched services to clients across 195 countries, solidifying our reputation as a global leader.

Banking

Credit Unions

Fintech

Back-Office Services

Frequently Asked Question

Get answers to your questions and learn more about how iComply can support your business

Latest Blog Updates

Read the latest from iComply – insights, news, and expert

commentary on digital compliance.

Overcoming Challenges in Digital Identity Verification for Enhanced Security

In an increasingly digital world, verifying the identity of individuals in online networks has become an essential part of security and compliance measures. With users from all over the globe utilizing digital applications to handle their banking, asset management,...

The Impact of Neobanks on AML and KYC Compliance: Ensuring Security in a Decentralized Era

As global financial institutions collectively face the reality of managing a consumer base that has aggressively adopted an increasingly digital presence, traditional banks are also facing a rising challenge in competing against a rapidly decentralizing model of...

Implementing Client Due Diligence in Credit Unions: Protecting Members and Ensuring Compliance

The evolving financial and political climate of 2023 and a post-pandemic market have left financial institutions and credit unions facing unique challenges as they navigate the new and growing risks associated with conducting business in an increasingly digital world....

Overcoming Challenges in Digital Identity Verification for Enhanced Security

In an increasingly digital world, verifying the identity of individuals in online networks has become an essential part of security and compliance measures. With users from all over the globe...

The Impact of Neobanks on AML and KYC Compliance: Ensuring Security in a Decentralized Era

As global financial institutions collectively face the reality of managing a consumer base that has aggressively adopted an increasingly digital presence, traditional banks are also facing a rising...

Implementing Client Due Diligence in Credit Unions: Protecting Members and Ensuring Compliance

The evolving financial and political climate of 2023 and a post-pandemic market have left financial institutions and credit unions facing unique challenges as they navigate the new and growing risks...