Robust and Efficient KYC Identity Verification

Navigating Identity Verification in the Digital Landscape

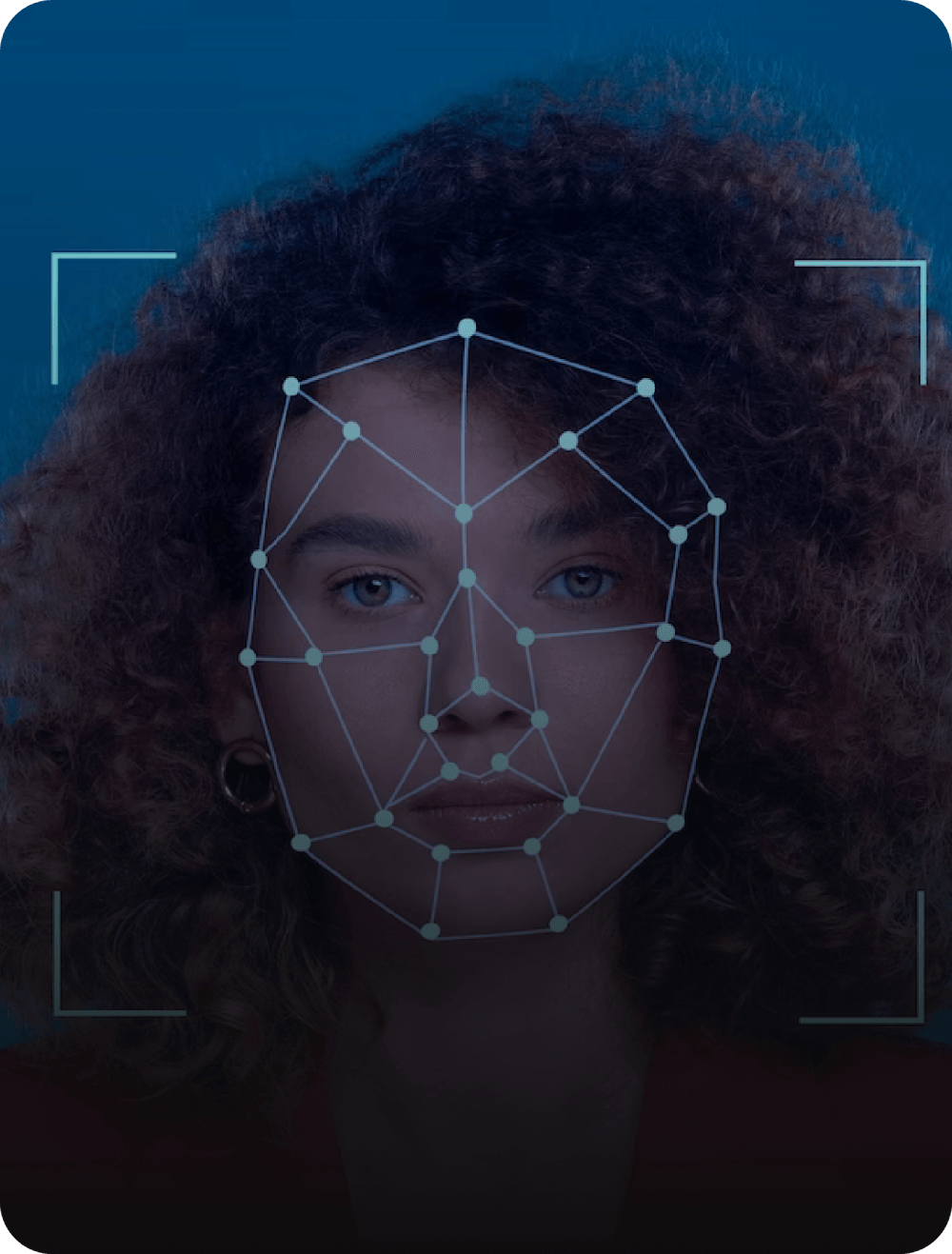

The Challenge: Identity Verification in a Digital World In the contemporary digital era, effective identity verification holds pivotal importance, especially within financial transactions, risk management, and regulatory compliance. The complexities and risks associated with modern-day verification processes necessitate a reliable and efficient solution.

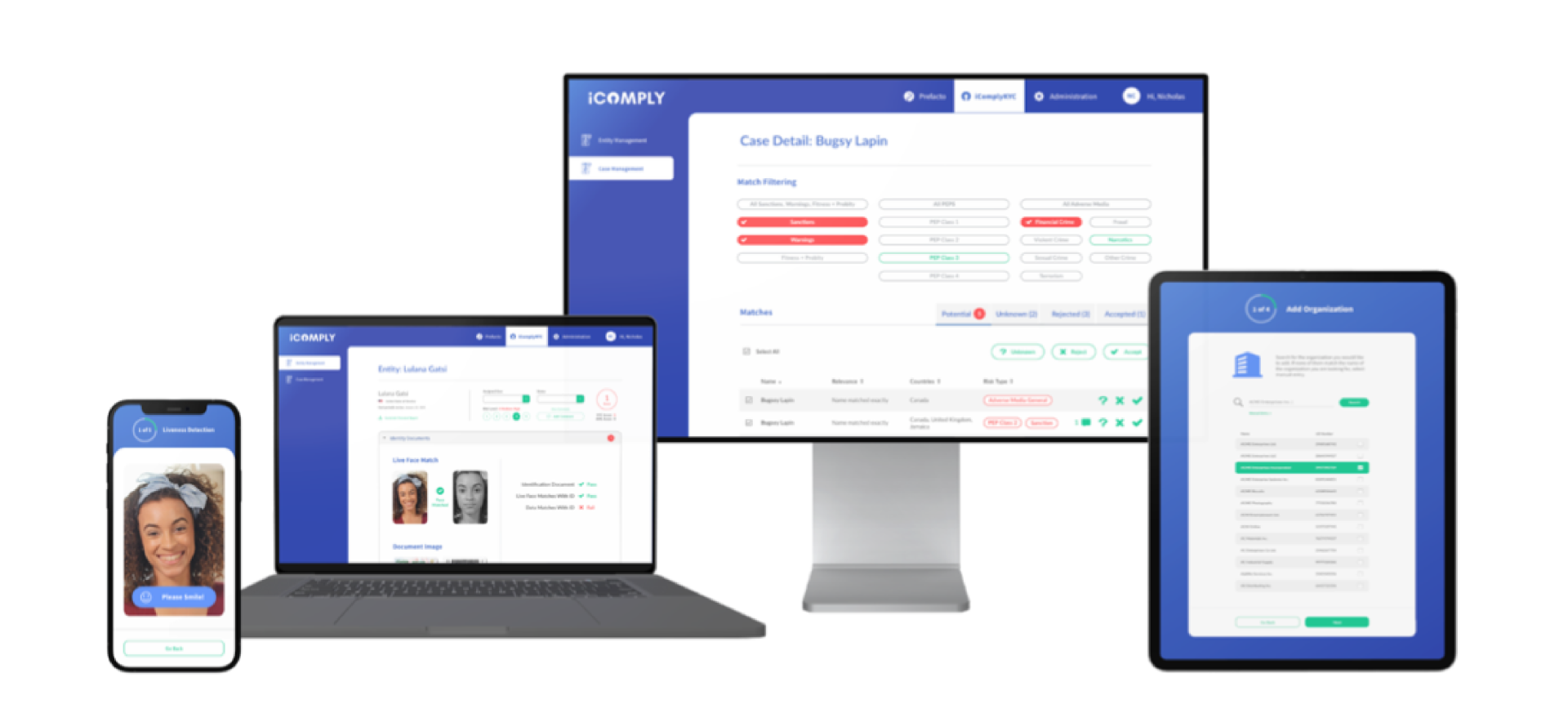

iComplyKYC™‘s Technological Response: AI and Edge Computing Enter iComplyKYC™ – a pioneering solution that harnesses the power of AI and edge computing technology. Our approach ensures swift, precise, and fortified KYC identity verification. This sophisticated combination of cutting-edge technologies empowers businesses to meet identity verification demands securely and expediently.

How KYC Identity Verification Works

iComplyKYC™‘s KYC identity verification process is comprehensive and systematic. It includes defining the verification scope, gathering information from a variety of sources, verifying the accuracy of the information through multiple methods, evaluating the information against defined criteria, and documenting the entire verification process for future reference.

Getting Started With iComplyKYC™

Register with iComplyKYC™ to access our comprehensive KYC identity verification solution. Secure your operations, build customer trust, and comply with international KYC and AML regulations.

Why Choose iComplyKYC™ for

Identity Verification

Efficiency Perfected: Unveiling iComplyKYC™’s Identity Verification Platform

Legal Agreements