Corporate Due Diligence: Best Practices for Risk Management Corporate due diligence is a critical process for managing risks and ensuring regulatory compliance in business transactions. Thorough due diligence helps organizations...

Exploring the Importance and Challenges of KYC Protocols

Exploring the Importance and Challenges of KYC Protocols

Are your fraud prevention protocols up to date with the latest Know Your Customer (KYC) and Anti-Money Laundering (AML) standards? In 2021, there was a 43% increase in fraud and computer misuse crimes compared to 2019, indicating that economic crime is on the rise. Having the right procedures and resources in place to prevent nefarious activities is essential for financial institutions and businesses.

With uncertain markets, ongoing global conflict, and a rapid influx of online banking users globally, 2023 has become a critical year for compliance legislation; failure to abide by evolving standards will likely spell even steeper costs for businesses than ever before.

At iComply, we know that using a proven KYC solution like our iComplyKYC platform is one of the best ways to streamline your operations and decrease your exposure to risk. As one of the leaders in identity verification and regulatory compliance, we’re proud to partner with clients across the globe to ensure you have everything you need to operate safely and efficiently. Below, we’ll take a closer look at some of the core elements that drive KYC legislation, as well as the benefits of using proven solutions like iComplyKYC.

What is KYC?

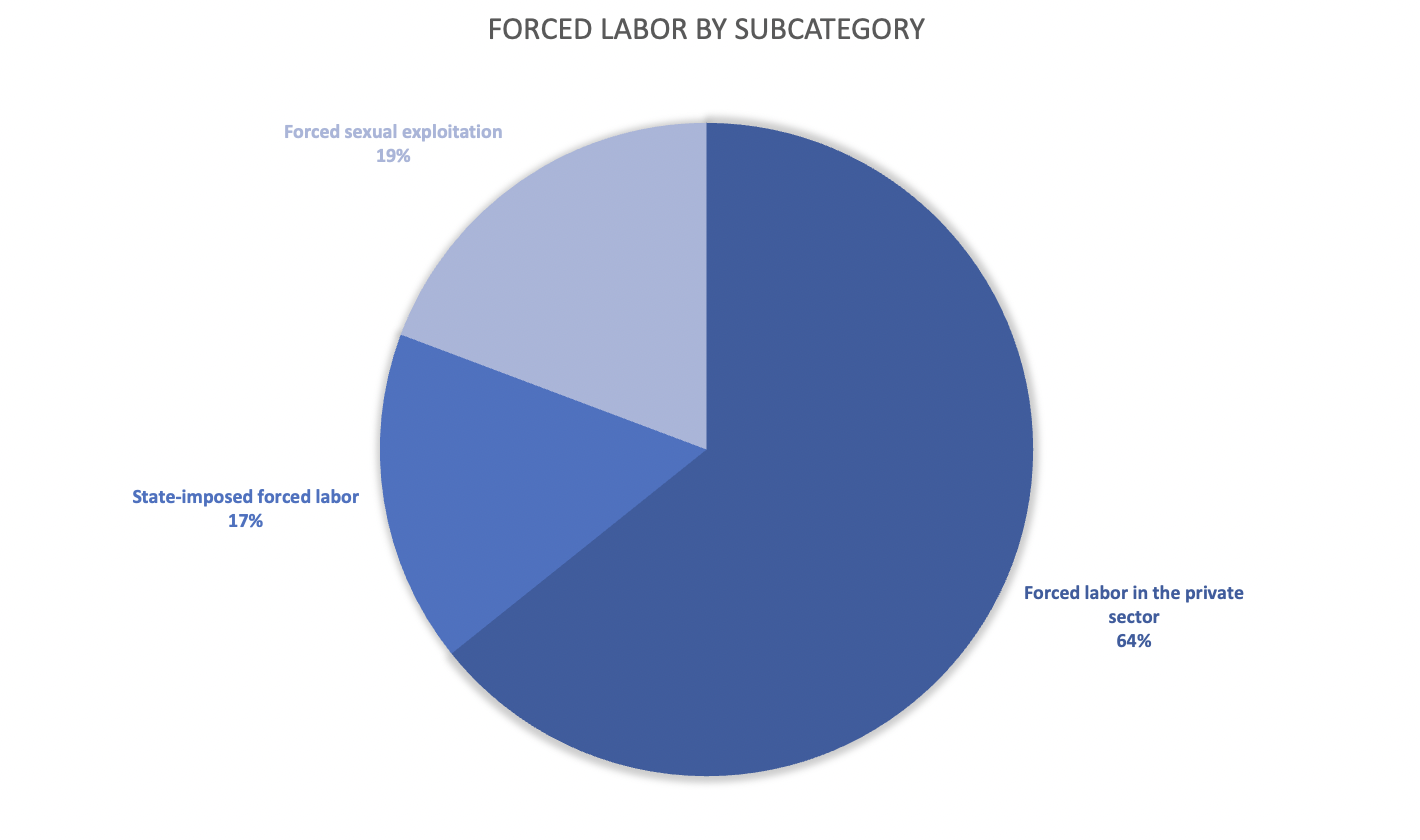

Know Your Customer (KYC) is a principle that refers to the practice of mitigating risk through the accumulation of verification-based information for unknown individuals and entities on a business level. From hiring new team members to securing a loan, adding a customer to your database, and more, KYC and AML protocols help to reduce the opportunity for criminals to conduct fraudulent practices and engage in nefarious activities like terrorist financing (CFT), human trafficking, the transfer of illegal products for financial gain, and more.

While KYC may not be a new concept (background checks have been an increasingly prevalent occurrence since the late 1970s thanks to both the Consumer Credit Protection Act and the Fair Credit Reporting Act), the constant push towards a more digital-centric existence makes being able to verify who you’re “working with” even more significant.

While each industry will have different points of consideration and corresponding legislation to accommodate when conducting KYC protocols, the end goal is to give businesses and their clients protection against fraud and other criminal acts that put the global marketplace at risk.

How Does KYC Mitigate Risk?

The unfortunate reality today is that international legislators and security watchdogs have yet to find a definitive method that completely halts the capacity for criminals to operate undetected in the financial sector.

While many of these crimes still go undetected, KYC and AML guidelines make it significantly harder for fraudsters to fly under the radar. By exposing fake users, flagging suspicious transfers, and performing other risk-reporting activities, organizations and regional legislators have a much better opportunity to address threats head-on and eliminate the misuse of funds or assets for nefarious purposes.

Addressing Global Challenges

One of the most difficult challenges facing the global regulation industry is pushing for the universal adoption of compliance guidelines, which, as mentioned above, currently differ regionally.

The EU and North America have the benefit of being able to leverage governing bodies like the FTC, Financial Action Task Force (FATF), Eurojust, Europol, and more, but not every country has embraced the need for KYC and fincrime prevention equally. This lack of balance presents regulators with a significant problem, as many of the highest-risk countries for illegal trafficking and fraudulent activity tend to have more relaxed (or an absence of) protocols that allow criminals to continue to operate unchecked with greater ease.

Though it may be easy to infer that financial crime is more centralized in such regions, the international community along with institutions that deal with financial and digital asset transactions must remember that rapidly evolving technology makes it more feasible than ever before for criminals to have a global reach. This makes compliance with KYC and AML protocols a necessity rather than a nicety; businesses need to be aware that failure to comply doesn’t simply result in fines, but can also lead to gateways for dangerous activities that affect the global community as a whole.

Why Partner With iComply

At iComply, we know the importance of having access to KYC protocols you can trust when it matters most. That’s why we’re proud to offer an innovative, modular-based suite of KYC programs that make it easy to stay compliant and adapt to evolving legislation.

iComplyKYC leverages cutting-edge AI and blockchain technology to ensure total regulatory compliance in over 245 jurisdictions worldwide and makes it easy to build fully-automated workflows for unique client types, jurisdictional requirements, and more with minimal downtime.

With a readily accessible 360º view of KYC data across your entire organization, you can move forward with confidence and know you are in the best position possible to combat fraud and financial crime and stay on the right side of KYC legislation in your region.

Ready to Discover More?

Contact us today to learn about iComply’s comprehensive, modular compliance solutions or to book a demo with one of our product specialists.

learn more

Is your AML compliance too expensive, time-consuming, or ineffective?

iComply enables financial services providers to reduce costs, risk, and complexity and improve staff capacity, effectiveness, and customer experience.

Request a demo today.

Corporate Due Diligence: Best Practices for Risk Management

Customer Identification: Best Practices for Accurate Verification

Customer identification is a critical process for financial institutions and businesses to verify the identities of their customers, mitigate risks, and ensure compliance with regulations. Accurate customer identification helps...

Enhancing Security with Liveness Detection Technology

In an era where digital fraud is increasingly sophisticated, liveness detection technology has emerged as a critical tool for enhancing security. This technology ensures that the biometric data provided during identity...