KYB, KYC, and AML Regulations in Europe

Key Regulations, Authorities, and Compliance Solutions for Businesses Operating in Europe.

Key EU AML Regulations

In Europe, the fight against money laundering and terrorist financing is governed by a comprehensive legislative framework and binding agreements between EU member and non-member countries.

The European Money Laundering Directives: There are currently six European Money Laundering Directives, with each directive building upon the last. These directives have established the EU’s legal framework for anti-money laundering and counter-terrorist financing. The Directives are particularly notable for extending the scope of KYB and corporate beneficial ownership, KYC and virtual client verification, and AML ongoing monitoring for sanctions, watchlists, political exposure, and adverse media.

The EU Anti-Money Laundering Authority (AMLA): A new regulatory body is being developed to focus on strengthening the EU’s fight against money laundering and terrorist financing. AMLA’s key functions include coordinating national efforts, directly supervising high-risk entities, ensuring regulatory consistency, and facilitating international cooperation.

Key Authorities

Compliance Strategies

Enhancing Operations: Improve efficiency and eliminate process failures with artificial intelligence and robotic process automation to scale KYB, KYC, and AML compliance operations.

For detailed information about the EU’s AML/CFT legislative package and what you need to do to comply, you can refer to the European Commission’s website here.

For a comprehensive overview of the EU Anti-Money Laundering Authority and its functions, you can visit the dedicated website here.

For insights into the most important AML and CTF regulations in the EU, the Financial Crime Academy offers a detailed breakdown here.

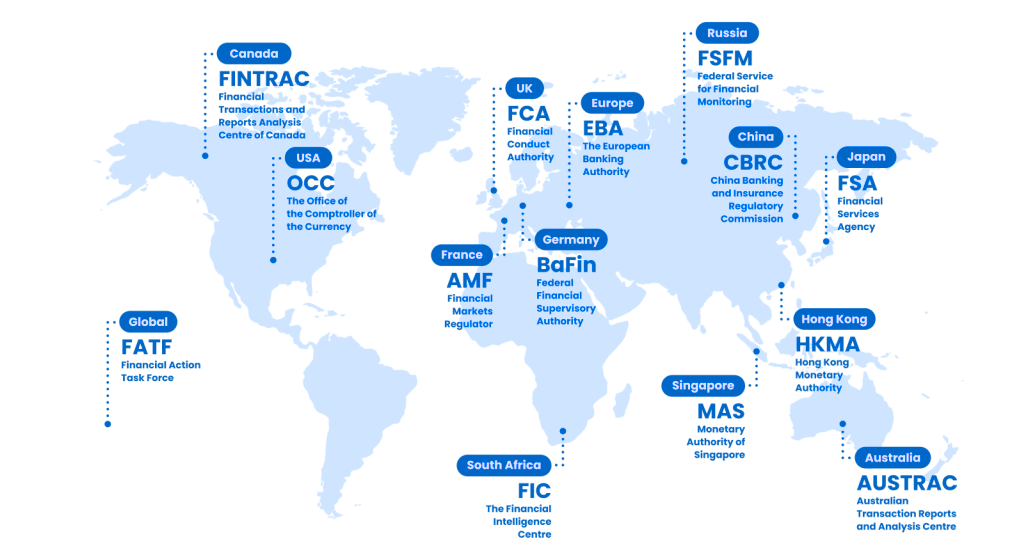

Supporting AML Regulations Around the World

Configure unique KYB, KYC, and AML workflows for Europe and aborad.

iComply solutions available in Europe

KYB - Know Your Business

Corporate onboarding, entity affiliation, complex beneficial owenrship, and more...

KYC - Know Your Customer

User onboarding, document authentication, biometrics, liveness, and more...

AML - Anti-Money Laundering

Screening and daily monitoring for sanctions, warnings, fitness, PEPs, adverse media, and more...

How iComply helps leaders in compliance

Global Coverage

Build unique workflows by country to manage KYB, KYC and AML operations supporting 142 languages, 13,500 government issued photo IDs, and domestic data processing in 195 countries.

Enhance Operations

Streamline KYB, KYC, and AML processes while consolidating 5-23 vendors. Reduce technical complexity, eliminate process failures and automate 90% of manual processes for your staff.

Customer Satisfaction

Improve your customer satisfaction by up to 25% with a frictionless customer experience whether at onboarding, to fulfill enhanced due diligence requirements, and periodic reviews.

Discover the Power of iComply solutions

Ready to take advantage of our complete KYB, KYC and AML solutions for European legal, accounting, financial services and crypto asset services providers?

Contact us today to schedule a demo.

Start your free trial of iComply

Cancel Anytime. No Questions Asked.