Anti-Money Laundering (AML) solutions are critical for law firms to prevent financial crime and ensure regulatory compliance. Implementing effective AML solutions involves strategic planning and the adoption of best practices....

Harnessing the Potential of Generative AI and Web3 for a Secure and Inclusive Future

Harnessing the Potential of Generative AI and Web3 for a Secure and Inclusive Future

Embracing the Future with Generative AI and Web3

In the ever-evolving landscape of technology, a new wave of innovations has emerged, holding the potential to address societal challenges and revolutionize the way we navigate the digital realm. Among these transformative concepts are the dynamic duo of Generative AI and Web3. These cutting-edge technologies promise to tackle issues such as data privacy, equitable access to services, and the impact of job displacement.

However, the successful deployment of these technologies requires a careful balance of ethical considerations, such as ensuring fairness and mitigating bias, especially with AI algorithms. Moreover, trust and privacy become increasingly critical in the decentralized systems of Web3, and the societal implications of such a drastic shift towards decentralization should not be overlooked. This article delves into the intersection of Generative AI and Web3, exploring their substantial capacity to mold a future characterized by security, inclusivity, and decentralization.

Understanding the New Wave: Generative AI and Web3

Generative AI has made remarkable strides in recent years, showcasing its capabilities through groundbreaking achievements like OpenAI’s DALL-E and ChatGPT, which successfully passed the Turing test. With the power to create original content across various sectors, Generative AI opens up a world of possibilities. On the other hand, Web3, known as the third generation of the internet, is built upon the foundation of blockchain and cryptocurrencies. This revolutionary concept incorporates technologies such as the Internet of Things and big data, enabling the development of decentralized applications within the Web3 ecosystem. Quite simply, this technology allows for decentralized, user-controlled online environments where information is distributed evenly among all participants rather than controlled by a few central entities.

While Generative AI has gained considerable traction, Web3 remains relatively uncharted territory for many. We can consider Web3 as a more secure, transparent and user-centric version of the internet, powered by blockchain technology. It allows for the creation of decentralized applications (DApps) that run on a peer-to-peer network, rather than being controlled by a single entity. It is a complex technology that demands a deeper understanding and technical knowledge to fully grasp its potential. Unlike widely recognized Generative AI tools, Web3 has yet to achieve widespread adoption and integration into everyday applications and services. However, the convergence of Generative AI and Web3 holds the key to unlocking an unparalleled realm of innovation and progress.

The Fusion of Technologies: Creating a Symbiotic Relationship

The merging of Generative AI with Web3 creates a powerful alliance, intensifying their individual impacts on the financial services sector. As we navigate the challenges and implications of AI, we must ensure that its economics align with the common good. The antidote to dystopian outcomes lies in collective and collaborative development. The financial sector has already experienced a significant shake-up with the rise of blockchain and Web3 technologies, as more individuals embrace decentralized alternatives to traditional financial systems. In this world, Generative AI could prove instrumental in simplifying and democratizing these complex concepts. For instance, AI could be used to explain tokenization in layman’s terms or help a newcomer understand the potential advantages and risks of investing in a particular DeFi platform.

Rather than focusing on cryptocurrencies, consider the broader landscape of tokenization enabled by blockchain. For instance, tokenization can transform a physical asset, like a house, into a digital token on the blockchain. This token represents ownership of the physical asset and can be bought, sold, or traded on the blockchain. It allows for increased liquidity and accessibility, as the token can be divided into smaller units, making it possible for more people to invest. Assets, be they real estate, artwork, or company shares, can be tokenized – a.k.a certified – with a blockchain, which permits individual ownership fractions and facilitates trading with unprecedented liquidity and transparency. Similarly, stablecoins, tied to stable assets like fiat currencies, offer price stability while maintaining the benefits of blockchain technology, such as transparency and security.

Furthermore, Decentralized Finance (DeFi) platforms built on blockchain infrastructures can empower individuals to participate directly in financial activities like lending and borrowing, bypassing traditional intermediaries. Such platforms can foster financial inclusion, allowing participants anywhere in the world to access and provide financial services. For instance, a small business in a developing country without access to traditional banking services could obtain a loan from a DeFi platform, enabling them to grow their operations and expand their business.

By combining the strengths of Generative AI and Web3, we can amplify this disruption and pave the way for a future where technology serves the common good, offering transparent and secure access to immutable, trustworthy data.

Practical Applications: How Generative AI and Web3 Can Work Together

Here’s how these technologies might work together to achieve this:

- Regulatory Automation: Leveraging Generative AI allows financial institutions to stay ahead of the curve in the complex regulatory landscape. By continually scanning for updates in rules and regulations, AI systems can autonomously evaluate an organization’s current compliance status in areas such as KYC, AML, customer due diligence, digital identity, and data privacy. Furthermore, these intelligent systems can proactively signal potential areas of concern and even draft plans for system updates or process modifications. When combined with the transparent and immutable characteristics of Web3, this innovative approach offers businesses a robust, future-proof strategy for managing regulatory requirements in the fast-paced world of financial services.

- Financial Inclusion: As – The emergence of Decentralized Finance (DeFi) platforms like Compound and Aave have reshaped access to financial services, particularly for those underserved by traditional banking infrastructures. However, the approach of bypassing conventional KYC, AML, and local disclosure requirements—often seen in cryptocurrency platforms—poses significant risks, including potential exploitation for money laundering, fraud, terrorist financing, and human trafficking. Therefore, the integration of Web3 and Generative AI must emphasize both the expansion of financial services and rigorous adherence to regulatory standards. This blend ensures a comprehensive, transparent, and resilient financial ecosystem that actively combats illicit activities.

- Generative AI for Personalization: Generative AI could be used to create personalized services, products, and content for individuals. When combined with the transparency and security features of Web3 technologies, this technology shows promise for user-focused, consent-driven, secure and inclusive digital environments. Imagine your own team of personal AI assistants.

- Data Ownership and Privacy: One of the key principles of Web3 is that users own their data. AI can be designed in a way that respects this principle, processing data in a decentralized manner without compromising user privacy. It is hard to understate the importance of this as many people and corporations cannot use tools such as ChatGPT due to valid concerns over data privacy and security. However, with the right combination of Web3 and AI, users will be able to have complete control over all of their personal data, documents, and even personal AI assistants.

- Transparent AI Systems: Blockchain, a core technology in Web3, can provide transparency and traceability. When used with AI, this can make the AI’s decisions and processes more transparent, helping to build trust and prevent misuse. On a practical level, consider the scenario of an AI system making a decision, such as approving a loan application or diagnosing a medical condition. With blockchain’s immutable record, all variables and steps the AI took could be recorded and made transparent, reducing the “black box” effect often associated with AI. It would also help to audit the AI system’s decision and ensure it aligns with ethical and legal standards.

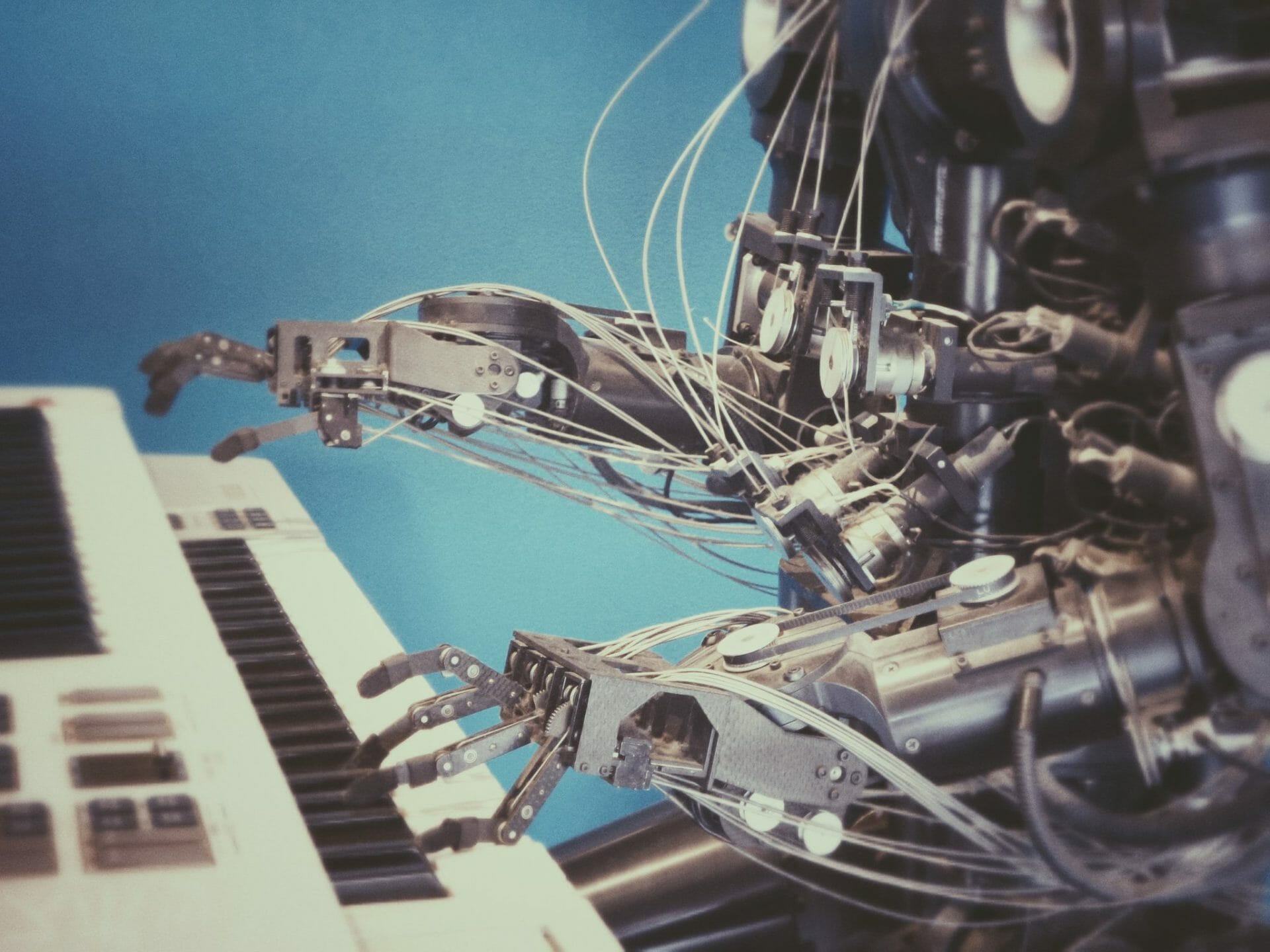

- Decentralization and Democratization: Web3 technologies like blockchain enable organizations to to redistribute power from centralized points of failure to individuals distributed anywhere in the world. When combined with AI, this could democratize access to advanced technologies and their benefits, potentially promoting equality and reducing disparities. For instance, in a developing nation, a farmer might lack access to critical information like weather forecasts, soil conditions, and market trends, which are crucial for improving crop yield and profitability. By leveraging decentralized platforms and AI, localized and personalized information could be provided directly to the farmer, effectively bridging the information gap.

The Potential for Innovation

The blending of AI and Web3 technologies sets the stage for substantial innovation. Picture AI assistants that do more than routine tasks – they can give you, the end user 100% privacy and security. This is not just an idea from science fiction; it’s a plausible future that becomes more attainable as these technologies converge.

For example, an AI-powered virtual assistant, embedded within the blockchain, could help users manage their digital identities, keep track of their assets, execute transactions, and provide personalized recommendations based on user preferences. All while ensuring the user’s privacy and control over their data.

AI can dynamically automate user identity verification, client onboarding, and customer due diligence empower decentralized decision-making through transparent data analysis across diverse sectors like finance, enterprise identity management, and healthcare. Take the example of a global bank. Today, customer onboarding and due diligence processes are labor-intensive and prone to errors and inconsistencies. AI could automate this process, improving accuracy, efficiency, and customer experience. Meanwhile, by leveraging the blockchain, the bank could securely store customer data and maintain an audit trail, ensuring regulatory compliance and enhancing data security.

The Future of Security:

The combination of AI and Web3 technologies are essential pillars in crafting the future of security, notably within the emerging realities of remote work, seamless client onboarding, and proactive risk management. It’s vital to distinguish between Web3 as a market, which is currently synonymous with the crypto space, and the broader suite of Web3 technologies which hold transformative potential beyond this sphere.

In this context, AI emerges as a potent tool, infusing cybersecurity measures with enhanced capabilities not just to minimize false positives but also to bolster the recognition of potential threats. Machine learning models, meticulously trained on transactional data, act as vigilant sentinels, spotting suspicious transactions, and fortifying the defense against fraud and money laundering across networks.

Harnessing the power of geometric machine learning, these AI systems transform into adept detectives that can pinpoint anomalous behaviors in real-time, thereby enabling prompt and strategic interventions to mitigate potential risks. This seamless integration of AI into various technological infrastructures exemplifies the evolving symbiosis of technology and safety in our digital world.

However, while some popular Generative AI solutions, including ChatGPT, present substantial data privacy and security risks to be used for this application at present, the emergence of secure, enterprise-ready solutions tailored to specific industries or even a company’s unique data set are rapidly improving in accuracy, data security, and cost. These advancements underline the massive potential and adaptability of AI and Web3 technologies in diverse contexts beyond their traditional market representations.

Closing the Gap:

The journey to bridge the gap between Web3 and traditional cybersecurity vulnerabilities is well underway. This involves innovative approaches to minimize the detection window for smart contract exploits. Imagine AI as a fine-tuned instrument, diligently pinpointing anomalies or monitoring for potential fraud in smart contracts. When integrated with multichain analytics platforms, this combination promises faster responses and fortified protection for blockchain based projects in financial services, real estate, and private enterprise. More than just a protective layer, AI also plays a crucial role in enhancing regulatory compliance, aiding in the detection of money laundering activities, and serving as a deterrent to white-collar crimes.

Innovative Trading Tools:

AI-powered trading tools are being developed to enhance decentralized exchanges in the Web3 ecosystem. These tools utilize AI “agents” to execute trades based on user-defined criteria, streamlining peer-to-peer transactions for decentralized finance users. By decentralizing the liquidity pool and utilizing smart contracts, the risk of cyber attacks is reduced, as there is no centralized pool of coins for hackers to target. Additionally, the use of smart contracts ensures a higher level of security, eliminating risks associated with rug pulls or exploitation of the underlying contract in decentralized exchanges (DEXs).

Promoting Inclusivity and Access:

The combination of Generative AI and Web3 also has the potential to foster inclusivity and broaden access to services. AI-powered virtual assistants can assist users in managing their digital identities, curating personalized experiences, and navigating the Web3 ecosystem. By leveraging AI algorithms and Web3’s decentralized infrastructure, individuals can have more control over their online presence, enhancing privacy and data ownership.

Advancing Web3 Security:

In the realm of cybersecurity, AI technology can play a crucial role in detecting and preventing threats within the Web3 ecosystem. By training AI models on transaction data and employing anomaly detection algorithms, potential security breaches can be identified and addressed in real-time. This proactive approach to security helps safeguard decentralized networks and ensures trust in the Web3 infrastructure.

Looking Ahead:

The fusion of Generative AI and Web3 unveils a spectrum of opportunities for constructing a safer, more inclusive, and decentralized digital space. Harnessing AI within the Web3 environment allows for enhanced personalization, bolstered security protocols, and improved decision-making algorithms. Yet, as these pioneering technologies continue to develop, we must give due attention to ethical issues, encourage responsible implementation, and foster collaboration among all stakeholders to guarantee equitable distribution of advantages.

On the precipice of technological advancement, the confluence of Generative AI and Web3 holds immense potential to revolutionize digital interactions. By leveraging the complementary strengths of these technologies, we can stimulate innovative breakthroughs, bolster security measures, champion inclusivity, and nurture a decentralized digital ecosystem rooted in equity. Navigating this significant crossroads demands a steadfast commitment to ethical norms and cooperative initiatives. Our collective efforts should aim to channel the transformative potential of these technologies towards comprehensive societal benefits and mutual progress.

Payments

Fireside Chat: Is Retail Wealth Management Ready for Virtual Assets?

Fireside Chat: Is Retail Wealth Management Ready for Virtual Assets?

Date: Thursday, September 10, 2020 | 10am PST – 1pm EST – 7pm CET

While interest in virtual assets from retail investors is surging worldwide, there is still a very limited number of wealth managers who meet the requirements to be able to advise their clients on investments in virtual assets.

Due to regulatory uncertainty and the emerging nature of the virtual asset industry, many wealth managers lack reputable information needed in order to be capable of advising their clients.

Join us for our latest fireside chat “Is Retail Wealth Management Ready for Virtual Assets?” featuring industry experts and thought leaders. In this session, we will cover:

- What impacts will virtual assets have on the principles of wealth management?

- What are the risks of making virtual assets available at the retail level?

- How are regulators in different jurisdictions helping to unlock access to virtual assets for retail investors?

- How does custody, private key management, and the FATF travel rule impact wealth managers?

- How are different jurisdictions approaching custody, wallet ownership, and the travel rule?

Join us for this free Fireside Chat on September 10th at 10am PST / 1pm EST featuring a live panel of trusted experts from around the globe.

iComply Investor Services Inc. (“iComply”) is a Regtech company that provides fully-digital KYC and AML compliance solutions for non-face-to-face financial and legal interactions. iComply enables financial services providers to reduce costs, risk, and complexity and improve staff capacity, effectiveness, and customer experience. By partnering with multinational technology vendors such as Microsoft, DocuSign, Thomson Reuters and Refinitiv, iComply is bringing compliance teams into the digital age. Learn more: www.icomplyis.com

Implementing Effective AML Solutions in Law Firms

Navigating KYB Compliance for Law Firms

Know Your Business (KYB) compliance is essential for law firms to verify the legitimacy of their business clients, mitigate risks, and adhere to regulatory requirements. This article explores the best practices and strategies for...

The Future of KYC and AML in Credit Unions: Trends and Technologies

The landscape of Know Your Customer (KYC) and Anti-Money Laundering (AML) is continuously evolving, driven by technological advancements and changing regulatory requirements. This article explores the future of KYC and AML in...

iComply Now Listed in the FINRA Compliance Vendor Directory

Vancouver, B.C. – July 28, 2020 – iComply Investor Services (“iComply”), a leading regtech software provider, is pleased to announce its listing in the Financial Industry Regulatory Authority (FINRA) Compliance Vendor Directory, which features vendors offering products, solutions, and services to firms overseen by the US regulator.

“iComply is dedicated to making the financial markets more robust, secure, and efficient,” said Matthew Unger, CEO and Founder of iComply Investor Services. “This listing in the FINRA Compliance Vendor Directory is an exciting moment in the company’s history as we continue to expand our client base and work with US firms to digitize their back office.”

iComply’s compliance management solutions offer institutional-grade identification and risk mitigation tools that support the complete AML compliance lifecycle for clients in industries ranging from professional services to online banking, capital markets, payment processing, trading platforms, virtual assets, as well as government and enterprise.

FINRA is an independent, government-authorized, not-for-profit organization that oversees U.S. broker-dealers. FINRA works under the supervision of the Securities and Exchange Commission (SEC) and writes and enforces rules, examines firms for compliance, fosters market transparency, and educates investors.

The Compliance Vendor Directory features companies specializing in: compliance consulting, cybersecurity, data management, information archiving, exam prep & firm CE, insurance brokers, monitoring & surveillance, PCAOB registered accountants, and registration services.

About iComply Investor Services Inc.

iComply Investor Services Inc. (“iComply”) is a Regtech company that provides fully-digital KYC and AML compliance solutions for non-face-to-face financial and legal interactions. iComply enables financial services providers to reduce costs, risk, and complexity and improve staff capacity, effectiveness, and customer experience. By partnering with multinational technology vendors such as Microsoft, DocuSign, Thomson Reuters, and Refinitiv, iComply is bringing compliance teams into the digital age. Learn more: www.icomplyis.com

How to Build an AML Program: A Step-by-Step Guide

Learn how to build an AML program with this step-by-step guide. Follow Mark, a UK fintech cofounder, as he creates a compliant AML framework with streamlined policies, KYB/KYC automation, and team training using iComply’s platform. Save time, reduce costs, and ensure regulatory confidence.

Customer Identification Procedures: A Smarter Approach to CIP for Modern Businesses

Revolutionizing Customer Identification Procedures (CIP) in 2025

Discover how technology is transforming CIP, enabling businesses to achieve seamless customer experiences, enhance security, and ensure global regulatory compliance.

Navigating the Regulatory Landscape: How One Fintech Stays Ahead of the Curve

Discover how a crypto asset services provider stayed ahead of regulatory changes, including FATF Travel Rule compliance, by using iComply’s automated platform. Learn how they streamlined workflows, reduced compliance risks, and built trust with clients and regulators.

Fireside Chat: DAOs and Decentralized Governance

Fireside Chat: DAOs and Decentralized Governance

How Decentralized Autonomous Organizations are Transforming Virtual Assets

Date: Thursday, July 30, 2020 | 10am PST – 1pm EST – 7pm CET

The history of DAOs is a short but interesting one. While the very first DAO was officially launched in 2014, the most famous example–The DAO–launched on the Ethereum blockchain in 2016 and raised more than USD $150M over a period of several weeks. Unfortunately, The DAO was exploited by a hacker and was drained of over $70M. Ultimately, the hack resulted in a hard fork of the Ethereum blockchain, returning the funds to the project’s creators.

While DAOs have marked a place in blockchain history, they are often misunderstood. Firstly, the term “DAO” means different things to different people and secondly, many open-ended questions typically come up in conversations about DAOs:

- What is a DAO?

- What makes a DAO autonomous in the first place?

- How do autonomous corporations practice truly decentralized governance today?

- Can I use a DAO to protect my company’s virtual assets?

- What makes a DAO a powerful tool in the virtual assets industry?

In a short period of time, the virtual asset marketplace has already gone through several waves of innovation—from initial coin offerings to security token offerings and decentralized finance.

Many experts and industry leaders have touted DAOs as the next major application of blockchain technology that will support virtual assets in the years to come.

Join us for our latest live fireside chat “DAOs and Decentralized Governance: How Autonomous Organizations are Transforming Virtual Assets” along with industry experts and thought leaders to discuss:

- What a DAO is, and how it functions in today’s global marketplace

- Key characteristics of DAOs and the pros/cons of each

- How virtual assets are being created and supported by DAOs

- Compliance considerations for creating and belonging to a DAO (reducing fraud and misuse of funds)

- Examples of DAOs in the marketplace (digital co-ops, guilds, mutuals, etc.)

We invite you to join us for this Fireside Chat on July 30th featuring an exciting lineup of panelists to learn more about DAOs and the role of decentralized governance.

About iComply

iComply Investor Services Inc. (“iComply”) is a Regtech company that provides fully-digital KYC and AML compliance solutions for non-face-to-face financial and legal interactions. iComply enables financial services providers to reduce costs, risk, and complexity and improve staff capacity, effectiveness, and customer experience. By partnering with multinational technology vendors such as Microsoft, DocuSign, Thomson Reuters and Refinitiv, iComply is bringing compliance teams into the digital age. Learn more: www.icomplyis.com

Implementing Effective AML Solutions in Law Firms

Anti-Money Laundering (AML) solutions are critical for law firms to prevent financial crime and ensure regulatory compliance. Implementing effective AML solutions involves strategic planning and the adoption of best practices....

Navigating KYB Compliance for Law Firms

Know Your Business (KYB) compliance is essential for law firms to verify the legitimacy of their business clients, mitigate risks, and adhere to regulatory requirements. This article explores the best practices and strategies for...

The Future of KYC and AML in Credit Unions: Trends and Technologies

The landscape of Know Your Customer (KYC) and Anti-Money Laundering (AML) is continuously evolving, driven by technological advancements and changing regulatory requirements. This article explores the future of KYC and AML in...