Risk in Digital Assets and Cryptocurrency: What Every CIO and CCO Needs to Know

Live Webinar: What Financial Institutions Need to Know About Cryptocurrency

Date: Wednesday, September 18, 2019, 11 am -12 pm EST

Public blockchains – and the cryptocurrencies running on them – are here to stay. Capital flows through cryptocurrencies, such as Bitcoin or Ethereum, continue to increase with some analysts forecasting that Bitcoin will soon surpass a $1T USD market cap. Meanwhile, the People’s Bank of China claims their state-backed “crypto RMB” will be “quite similar to” Facebook’s Libra Project, which is yet another project to spark global discussion. How do financial institutions manage risk related to digital assets and cryptocurrencies?

In this webinar, Dan Peak, Board Advisor at CaseWare RCM and former CEO for World-Check (now Refinitiv) and Greg Pinn, Head of Product Strategy at iComply Investor Services and former Head of Product at Thomson Reuters World-Check will discuss systematic processes that every financial institution should go through when evaluating the risks associated with cryptocurrencies and effective mitigation strategies.

Join us for this discussion covering:

- Overview of cryptocurrency and cryptocurrency regulated businesses

- Business challenges associated with working with cryptocurrencies

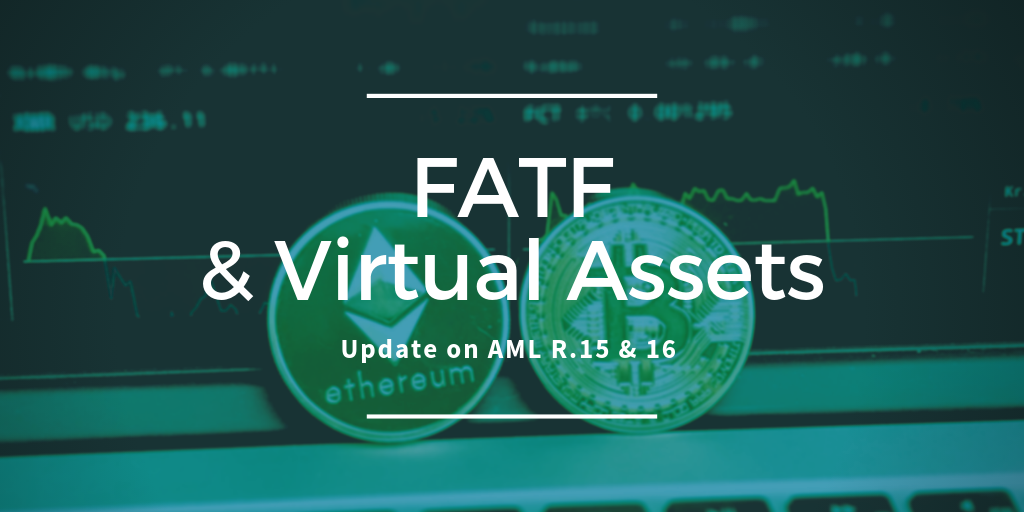

- High-level view of the current regulatory landscape

- Differences between risks associated with fiat and cryptos

- How to manage onboarding, screening, transaction monitoring and regulatory reporting with cryptocurrencies

Sponsored by Refinitiv

Serving more than 40,000 institutions in over 190 countries, Refinitiv provides information, insights and technology that drive innovation and performance in global financial markets. Our heritage of integrity enables our customers to make critical decisions with confidence while our best-in-class data and cutting-edge technologies enable greater opportunity.

About Alessa

Alessa (formerly known as CaseWare Monitor), is a product of Caseware International and is used in more than 20 countries by banking, insurance, FinTech, gaming, manufacturing, and retail companies to identify high-risk entities and activities early, engage the business to investigate and remediate any potential issues and comply with regulations. This is achieved by seamlessly making fraud prevention and compliance part of business day-to-day activities.

About iComply

iComply Investor Services Inc. (iComply) is an award-winning software company focused on reducing regulatory friction in the capital markets. With powerful data, verification, and technology solutions, iComply helps companies overcome the cost and complexity of multi-jurisdictional compliance to effectively access new markets. Learn more: iComplyIS.com

Interview with Matthew Unger, CEO of iComply, on Financial Crime Prevention and Deep Fake Prevention

iComply Investor Services Inc. Forms Strategic Partnership with Qoden to Enhance KYC Processes

Vancouver, Canada - iComply Investor Services Inc., a leader in compliance technology, is excited to announce a strategic partnership with Qoden, a premier technology company specializing in advanced trading platform solutions. This partnership is centered around...

Harnessing the Potential of Generative AI and Web3 for a Secure and Inclusive Future

Embracing the Future with Generative AI and Web3 In the ever-evolving landscape of technology, a new wave of innovations has emerged, holding the potential to address societal challenges and revolutionize the way we navigate the digital realm. Among these...