AI-Powered Transaction Monitoring Software

The Best Know Your Transaction (KYT) Solutions for Fintech, Payments, VASPs, and Money Services Businesses

Why Choose iComply for Transaction Monitoring?

No more fragmented systems, automate manual processes, reduce risk, cost, and processing time.

Enjoy deep integration with the world’s best AML software – out of the box! Our Know Your Transaction (KYT) transaction monitoring system seamlessly communicates with our KYB system, KYC software, and AML screening services.

Gain a 360 view view of risk in real time – your single source of truth for every client and transaction.

Struggling With Transaction Monitoring?

Automate, streamline, and scale your AML compliance operations with iComply.

Automate Your Risk-Based Approach to Transaction Monitoring in Real Time

Every transaction—fiat, crypto, domestic, or cross-border—is analyzed in milliseconds using configurable rules and powerful AI models. Set thresholds and risk scenarios by transaction value, velocity, geography, counterparty, risk level, device fingerprint, or customize to your unique scenarios.

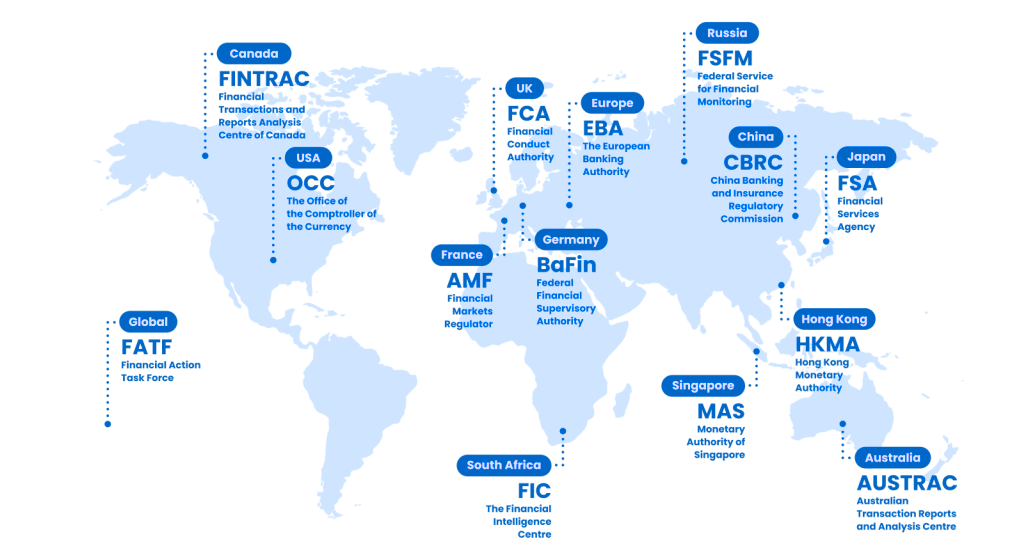

Streamline AML Compliance Across Jurisdictions

Localize rule sets, meet Customer Due Diligence (CDD) obligations, fulfill MiCA and FATF Rec. 15+16, and adapt to local Financial Intelligence Unit (FIU) regulations in just a few clicks.

Configurable rules – set thresholds and scenarios to support your risk-based approach.

Audit-ready report logs for easy monitoring, internal review, and regulatory reporting.

Role-Based Access Control (RBAC) for compliance officers, managers, analysts, partners, and managed services providers.

Batch Processing and Continuous Monitoring

Integrate iComply’s transaction monitoring solution into your core systems for real-time continuous monitoring, upload transaction for batch processing, or use our intuitive user interface to process ad-hoc transactions.

Our AML transaction monitoring software is designed to easily adapt to your uniqure business requirements – optimize your AML compliance operations for effectiveness and efficiency.

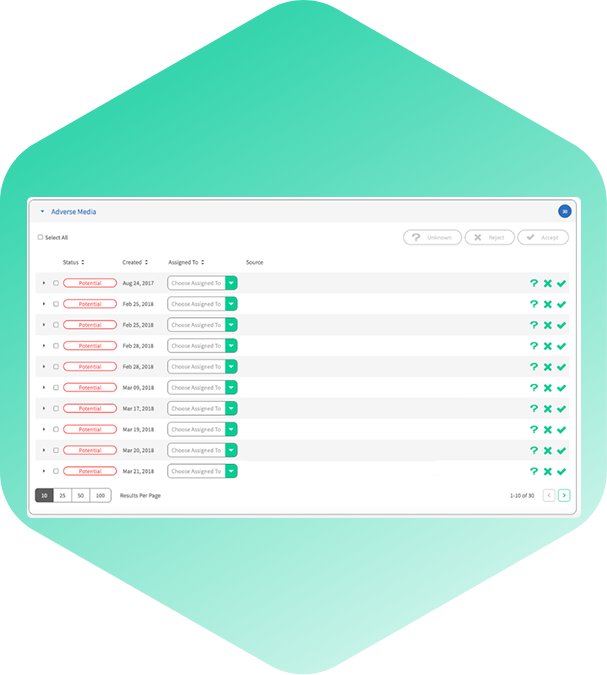

Scale KYT Alerts & AML Case Management

Configure alerts based on risk indicators and custom scenarios, monitor transactions and alerts, filter, review and report – All from one unified AML transaction monitoring dashboard.

Real time alerts bring risk to the surface for your team to remediate.

Prioritize and route cases based on severity, team capacity, and risk type.

Create audit trails for internal reviews and regulatory reporting.

Flexible and Scalable Architecture

iComply’s architecture supports financial service providers of any size, from emerging fintechs and crypto to multi-national banks and payment processors.

Scale effortlessly – whether you are processing hundreds or millions of transactions. Our transaction monitoring system delivers uncompromising speed and security.

Ensure uptime and performance with elastic scaling logic, optimized infrastructure routing, and geographical server redundancies.

Built with iComply’s proprietary edge computing technology to ensure data sovereignty, faster processing, and unmatched transparency.

Built for Forward-Thinking Financial Institutions

Whether you’re an emerging fintech or crypto company, an established bank or payment processor – iComply delivers the best AML transaction monitoring solutions that protect your business.

Safeguard your operations from regulatory fines, fraud, and reputational risk—without compromising your customer’s experience.

Ready to Automate Your AML Compliance?

Schedule a meeting with our sales team to discover how iComply’s transaction monitoring systems can become your competitive edge.