KYB Corporate Onboarding

Streamline Know Your Business (KYB) processes and transform your corporate client onboarding into a word-class customer experience.

Navigating Corporate Onboarding, Verification & Fraud Detection

Today’s Top KYB Challenges

- Corporate onboarding is painful and cumbersome for your clients.

- Compliance teams are struggling with complex manual processes and fragmented systems.

- Fraudsters are using AI, deepfakes, voice clones, and stolen identities proficiently.

iComply’s Pioneering Approach

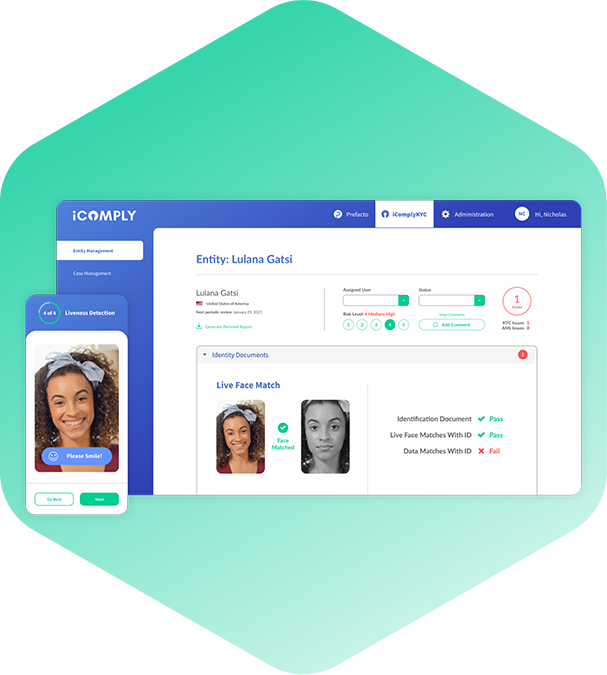

- Improve customer satisfaction by over 25% with dynamic KYB portals embedded into any web or mobile application.

- Automate over 90% of KYB processes and streamline AML compliance operations.

- Deter fraudsters and detect risk with AI powered active liveness, facial biometrics, and trusted global data sources.

KYB Solutions for Corporate Onboarding

Ensure your KYB process is efficient and secure.

Leverage iComply’s proprietary edge computing technology to process and encrypt sensitive data and documents before they leave your customer’s device.

Comply with new data privacy and security requirements of your Financial Intelligence Unit (FIU) by processing and storing all corporate and personnel data locally – spanning 195 countries.

Configure KYB Portal Workflows

Build dynamic workflows, style and design KYB portals to match your brand, embed into any web or mobile application

Accelerate Beneficial Ownership Discovery

Streamline and automate corporate customer due diligence processes, trigger dynamic enhanced due diligence

Validate Company and Affiliate Data

Access trusted data sources spanning millions of corporate records worldwide with our KYB Enrichment Data

Custom Questionnaires and Rule Sets

Configure secure web forms to collect, validate, and encrypt data and documents to match your unique business requirements.

Collect Supporting Documents

Automatically gather corporate records, financial statements, regulatory filings, certificates of incorporation and more

Verify Authorized Respresentatives

Compare an image of the identity document with a government-issued reference image to ensure authenticity

Why Choose iComply for Corporate Onboarding?

What Makes iComply’s Corporate

Verification Solution Stand Out?

Mitigate risks and expedite your corporate onboarding process with iComply:

Efficient Onboarding

Reduce time spent on manual onboarding processes.

Comprehensive Verification

Perform thorough checks using our expansive business database.

Enhanced Data Security

Ensure top-tier data security for your corporate onboarding.

Proof of Verification

Keep detailed records with proof of each verification.

Automated Monitoring

Stay updated with our automated monitoring processes.

Interested in exploring our other modules?

Getting Started With iComply

Enhance your document verification process with iComply.