Turnkey Virtual

Verification for

Law Firms

Meet your law society requirements for virtual client identification during client onboarding, reviews, and in live videos calls.

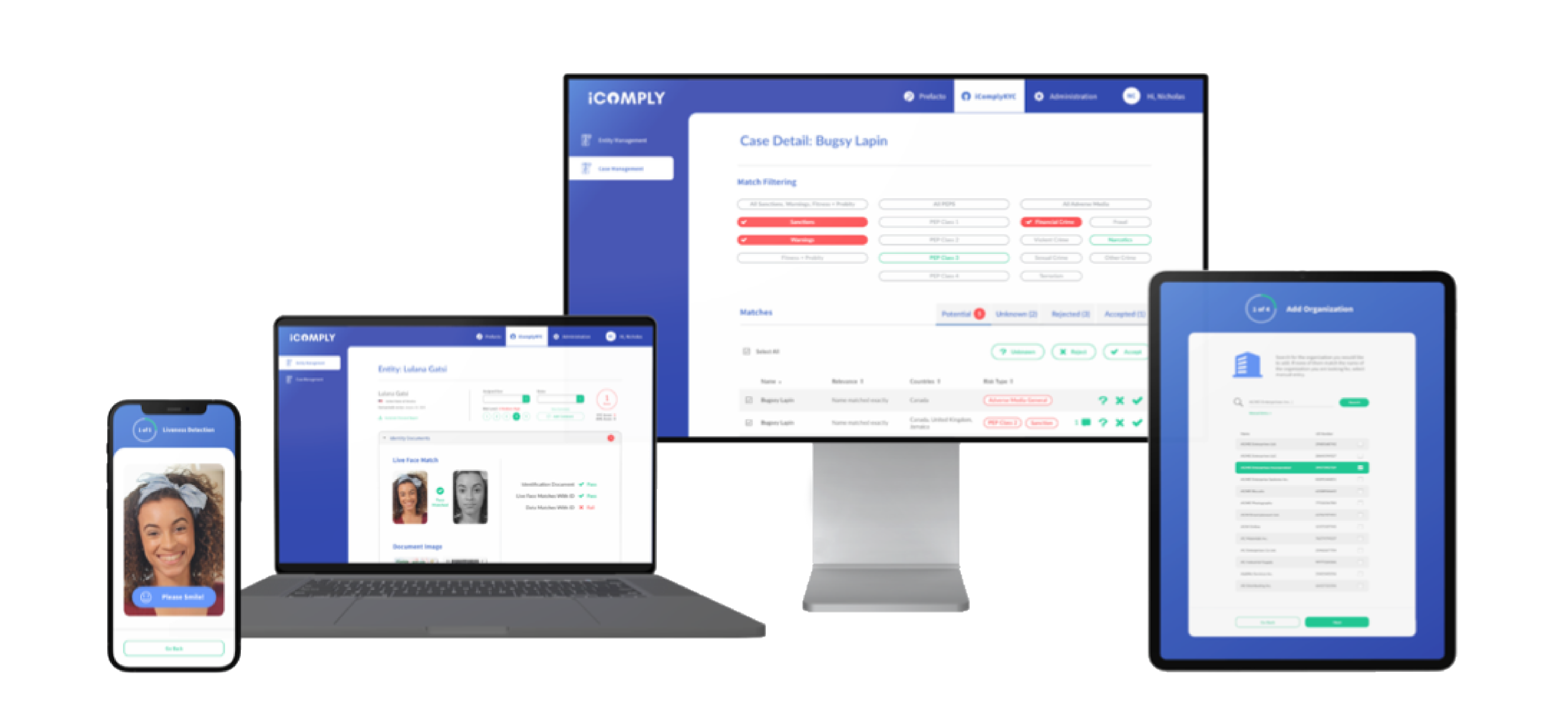

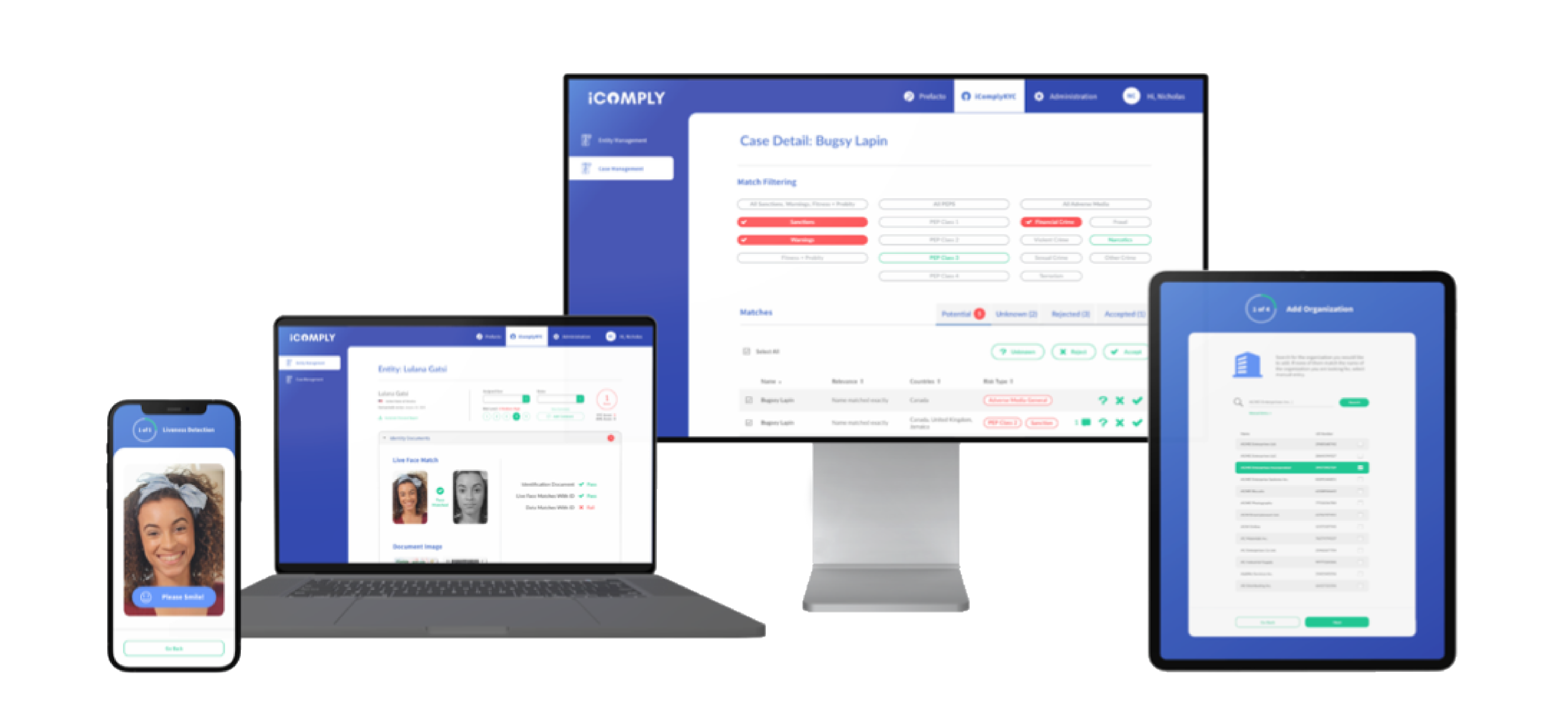

Virtual Verification of Your Customer’s Identity

Authenticate and verifiy photo IDs, customer data, and biometrics

As a original member of DIACC – Digital Identity Authentication Council of Canada since their inception, iComply has been at the forefront of virtual client verifications and video calls serving law firms in Canada, the United States, the United Kingdom, and across Europe.

Identify and Assess Risk

Streamlined and automate workflows, dashboards, and client portals for due diligence, sanctions and political exposure screening and monitoring.

Authenticate Photo IDs

Detect security features, watermarks, size, format, design, MRZ and barcode, data extraction and validation on photos IDs from 195 countries.

Record Keeping

All records are compiled and retained based on your specific requirements – including applicable dates and

documents obtained.

Data Validation

Extract and validate user biometrics, age, address, date of birth, and document expiry data from photo IDs

Virtual Meetings

Conveniently interview and walk your clients through a seamless front end KYC portal using industry leading, encrypted, peer-to-peer video calls.

Trusted by Leaders in Compliance

iComply’s KYB (Know Your Business), KYC (Know Your Customer), and AML (Anti-Money Laundering) solutions are vetted to meet the highest legal and professional standards, ensuring compliance with your law society’s rules for virtual client verification, corporate due diligence, and sanctions screening.

iComply’s solutions leverage edge computing and artificial intelligence to process your client’s most sensitive data on their own device. Collecting personal or corporate identity documents via email permanently exposes your clients to identity theft and fraud. Data breaches in API based solutions and credit bureaus systems happen so often they hardly make headlines. Improve client trust, user experience, and adhere to the latest requirements to ensure your practice is not exploited for laundering money or financing terrorism and human trafficking.

Tailored Software for Law Firms

Secure, Reliable, and Scalable.

Setup in Minutes

We offer turnkey low-code and no-code solutions to deploy your unique workflows, brand, and styling in a single setup and onboarding session.

Unlimited Flexibility

Our solutions are configurable to support 195 countries, 142 languages, and 13,500 identity documents.

Client Satisfaction

Dramatically improve customer experience, reduce process failures, and spend less time on client due diligence with greater accuracy.

Enhanced Cybersecurity

Ensure the safety of your client’s data with unparalleled data privacy and protection powered by edge computing and AI.

Streamline Virtual Verification

Contact sales today and discover how iComply can help you onboard clients faster, identify risk in real-time, and adhere to your law society’s rules for serving your clients remotely.