iComply Attracts Angel Investment from MIT Fellow

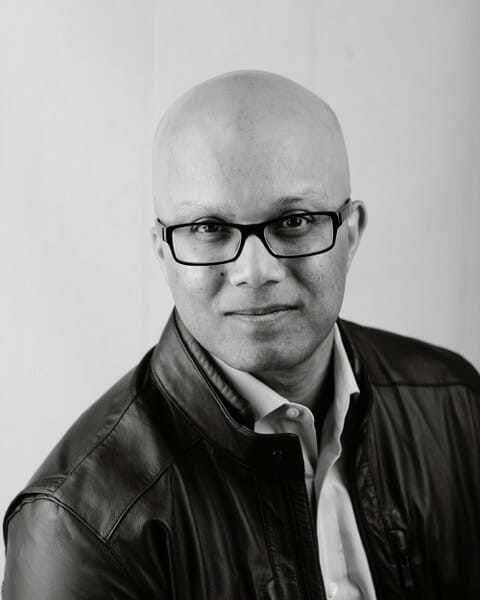

iComplyICO was mentioned in CryptoNinjas this morning highlighting our advisor and angel investor Praveen Mandal.

iComply Attracts Angel Investment from MIT Fellow – CryptoNinjas (via Coin Wisdom)

By: CryptoNinjas

iComply (iComply Investor Services Inc.), an AI-supported, compliance platform that automates securities regulation to enable companies to use the technology of initial coin offerings (ICOs) for traditional securities, today is announcing that it has secured angel investment from Praveen Mandal and appointed him to… Read the full article here.

Looking for an end-to-end token management studio?

iComply’s token compliance platform, Prefacto enables issuers to capture the value of blockchain asset management with multi-jurisdictional compliance automation for over 150 countries.

Book a demo with one of our specialists to learn more.

About iComply Investor Services Inc.

iComply Investor Services Inc. (iComply) is an award-winning software company focused on reducing regulatory friction in the capital markets. With powerful data, verification, tokenization solutions, iComply helps companies overcome the cost and complexity of multi-jurisdictional compliance to effectively access new markets. Learn more: iComplyIS.com

A Quick-Start Guide to AML Compliance

Building a Robust AML Program: A Compliance Officer’s Guide

Learn how to streamline AML compliance with digital onboarding, automated SAR submissions, secure record keeping, and a risk-based approach.

The Future of KYB: Streamlined Verification for Seamless Business Transactions

KYB Made Easy: Streamlining Business Verification

Discover how modern KYB technology is simplifying business verification, making it faster, more secure, and user-friendly. Learn how automated checks, biometric verification, and real-time compliance can benefit your business.

The Future of KYC: A Digital Journey Through Verification

The Future of KYC: A Seamless Digital Experience

Explore how modern KYC technology is transforming identity verification, making it faster, more secure, and user-friendly. Discover the benefits of biometric authentication, blockchain security, and self-sovereign identity.