Trusted by AML Compliance Leaders Worldwide

Know Your Business - Streamlined KYB Solutions

Accelerate beneficial ownership & UBO discovery to simplify complex ownership structures with corporate onboarding, supporting documents, & questionnaires.

Know Your Customer - Automate KYC Verification

Automate identity verification, liveness, face-match, geolocation, supporting documents, & questionnaires.

Anti-Money Laundering - Global AML Screening

Global AML checks are monitored daily for sanctions screening, politically exposed person screening, and adverse media screening.

Start your free trial of iComply

Cancel Anytime. No Questions Asked.

Compliance Failures Cost Time, Money, & Trust

Disjointed Vendors

Complicates operations, drains development resources, and introduces risk

Manual Processes

Limits growth, requires excessive workforce resources, and increases human error

Negative Customer Experiences

Erodes trust, brand value, and competitive advantage

Streamline Your KYB, KYC, & AML Compliance

Eliminate Vendor Complexity

Configure your ideal solution – Deploy our turn-key AML software in days or request customizations unique to your requirements

Boost Efficiency & Effectiveness by up to 90%

Configure intuitive workflows and automation to apply your policies and procedures at scale

Improve Customer Satisfaction by over 25%

Offer a white-glove customer experience using our white-labelled onboarding portals

World-Class Privacy, Security, & Encryption

Adhere to data protection regulations including SOC2 and ISO 27001, CCPA, GDPR, PPIA, PIPEDA, PCI, and more.

Process and secure all sensitive data, documents, and biometrics on the user’s own device, not our servers, using the power of edge computing.

Leverage best practices with end-to-end encryption (TLS1.2, SSL, AES256) to store member data on your servers or clouds.

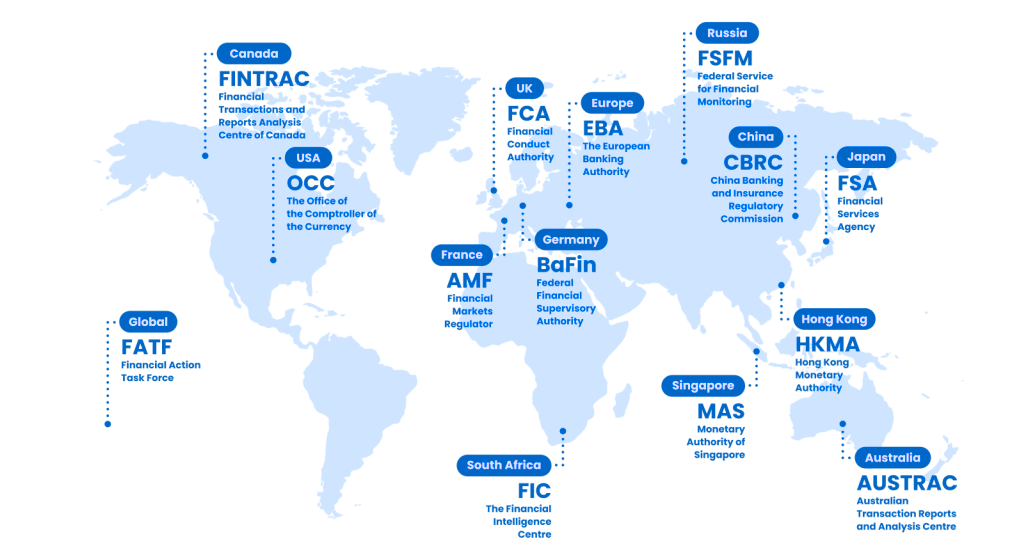

Global AML Compliance

Streamline and automate compliance in 195 countries.

14,000+ Identity Verification Documents

3,000+ Watchlists for Sanctions Screening

11,000+ Trusted Sources for Adverse Media Checks

PEPs Class 1-4: Politically Exposed Persons

We have settled in with your service and are very impressed. I have every confidence in iComply for the UK, where increasing pressure from regulators to not only improve AML compliance, but also to be able to demonstrate it.

Frequently Asked Questions

Learn more about about AML compliance, customer due diliegnce, and how iComply can support your business

Start your free trial of iComply

Cancel Anytime. No Questions Asked.