Frequently Asked Questions

Need help? We’ve got you covered!

Getting Started

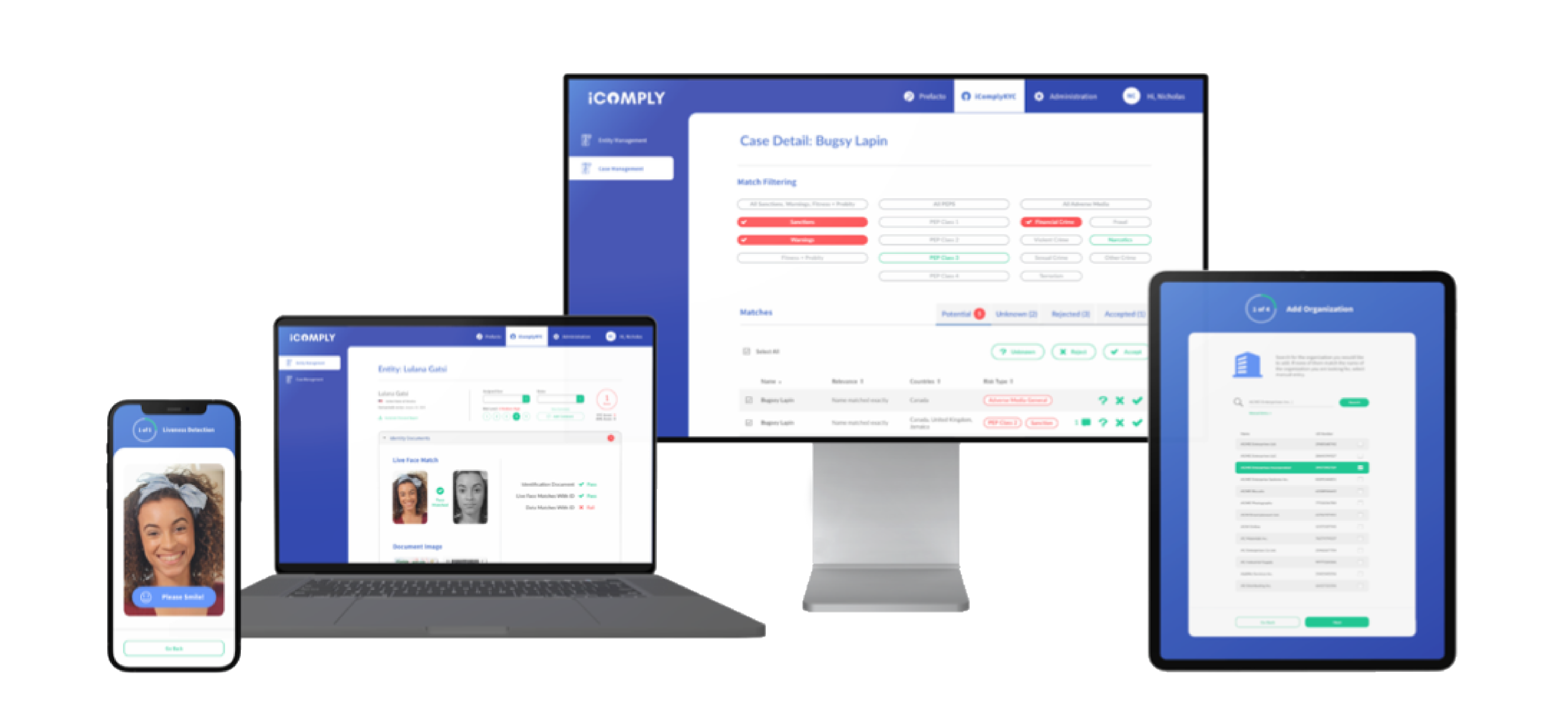

What is iComply, and how does it support compliance operations?

iComply is an all-in-one platform for KYB, KYC, KYT, and AML compliance. Our modular solution replaces fragmented tools with a unified system for onboarding, verification, risk screening, and ongoing monitoring—across 195 countries.

What components constitute an effective AML compliance program?

Risk assessments, identity verification, transaction monitoring, and suspicious activity reporting are core.

How does iComply assist in developing and maintaining an AML program?

We provide templated workflows, custom risk models, on-demand screening, continuous monitoring, and automatically-generated audit-ready logs.

What is the role of risk assessments in AML compliance?

Risk assessments guide how much due diligence is needed. Our system dynamically scores users and entities.

How do I initiate a free trial with iComply?

You can start your 14-day free trial instantly. Just choose the right plan for your business and sign up. Don’t worry, you can cancel anytime – no questions asked. The free trial includes access to all core features.

What features are included in the free trial?

Trial users can get access to KYB, KYC, and AML screening modules with a limited volume of verifications and workflow automation.

Is any software installation required to use iComply?

No. iComply is the only edge-native compliance platform in the world and fully browser-based so it will run on any device with no software to install or redirects for your users.

Which integrations are available with iComply?

We can deliver secure integrations into most modern technology products, platforms, and your preferred compliance data sources. We offer robust APIs for custom workflows, schedule a call with our sales team to discuss your unique integration requirements including Salesforce, Hubspot, Microsoft, Thetaray, eBankIT, and more.

Can iComply integrate with existing AML systems and processes?

Yes. Our APIs and webhooks allow seamless integration with your back-office or case management tools.

What’s the typical onboarding process and timeline?

You can go live in minutes using our SaaS dashboard. Most Pro clients fully deploy within 2–4 weeks, and Enterprise accounts typically within 1-3 months – including custom configurations.

Can iComply be customized to fit our specific compliance workflows?

Yes. Our platform supports no-code and low-code customization, including risk scoring, triggers, country-specific workflows, custom web forms and document collection logic.

Pricing and Plans

What pricing tiers does iComply offer?

Essentials, Plus, Pro, and Enterprise—scalable by feature, volume, and deployment preference.

Is there a pay-as-you-go option or volume-based pricing?

Yes. Essentials plans are available on a pay-as-you-go basis with a setup fee and deposit. Plus, Pro, and Enterprise tiers support tiered pricing and monthly usage-based billing.

Are there any setup or onboarding fees?

No setup fees for Essentials or Plus. Pro and Enterprise may include bespoke packages for onboarding, implementation, training, and other managed services.

What payment methods are accepted?

Major credit cards, ACH, wire transfers, and enterprise invoicing are supported.

Can plans be customized to fit specific business needs?

Yes. Pro and Enterprise plans are customizable, including hybrid integrations.

Are discounts available for long-term commitments, startups, or non-profits?

Yes. We offer discounts for multi-year contracts and eligible organizations. Contact sales for details.

Platform Questions

How is the iComply platform structured?

The platform includes four modules—KYB, KYC, KYT, and AML—each of which can operate independently or as part of an integrated stack.

What distinguishes KYB, KYC, KYT, and AML modules within iComply?

KYB handles legal entities. KYC verifies individuals. KYT monitors transactions. AML flags and screens for financial crime risk, political exposure, adverse media and negative news.

Is it possible to use individual modules separately?

Yes. You can start with one module and scale up as needed. Each integrates seamlessly into your existing business processes, compliance policies, and procedures. Naturally, to maximize your accuracy, efficiency, and user experience – we have engineered each module to seamlessly interface with the others.

What is perpetual KYC (pKYC), and how is it implemented?

pKYC enables continuous monitoring and automated KYC refreshes based on risk triggers—like ID expiry or new PEP status—rather than static schedules or ad-hoc KYC reviews.

How does iComply stay updated with evolving AML regulations?

Our regulatory intelligence is continuously updated by real-time monitoring of the regulatory horizon. We contribute to the FATF guideance and aligned standards across leading jurisdictions. Our platform releases include workflow updates and new features ahead of or in sync with changes to global or jurisdiction specific changes to AML regulations.

Does iComply support batch processing for compliance tasks?

Yes. You can upload files or trigger automated workflows via API for batch onboarding, KYB refreshes, KYC refreshes, transaction monitoring or AML risk screenings.

How does iComply ensure scalability for growing businesses?

Our global AML compliance platform is built for scale—from startups to global institutions—with local data processing via edge-computing and auto-scaling infrastructure up to billions of events daily.

KYB Questions

What documents are required for Know Your Business (KYB) verification?

Common KYB documents include business registration, tax ID, UBO declarations, and licenses. Requirements can be adjusted by jurisdiction and will vary based on your own AML policies, procedures, and operational needs. The iComply platform easily adapts to your businesses policies and procedures at scale.

Who qualifies as an Ultimate Beneficial Owner (UBO), and how are they identified?

UBOs are individuals with significant stake (typically those with over 20 – 25% ownership in most jurisdictions). Our platform allows you to trace beneficial ownership through even the most complex ownership structures to determine who are the real UBOs of any type of legal entity in any jurisdiction.

How frequently should KYB checks be conducted?

We recommend KYB refreshes be done at least annually or triggered through continuous monitoring of high risk events (e.g., address change, director updates, ownership changes, etc.).

Does iComply support KYB compliance across multiple jurisdictions?

Yes. We pride ourselves in how flexible, configurable, and adaptable our KYB solutions are. You can build out workflows to meet jurisdiction-specific requirements globally – spanning 195 countries.

Can iComply detect shell companies or fraudulent entities?

Yes. Our KYB solutions enable advanced UBO tracing, access to corporate details via KYB Data Enrichment, and robust identity verification procedures on the key individuals related to the legal entity in question to detect synthetic identities and unravel complex corporate strustures.

Can iComply verify whether an individual is an authorized representative of a legal entity?

Yes. Depending on the data available on the entity in question, this could be fully automated or escalated for quick decisioning by your analysts as part of your streamlined customer due diligence process.

KYC Questions

What are the steps involved in the KYC process with iComply?

Steps include authentication of one ore more identity documents, biometric verification using 3D facial recognition combined with hybrid active and passive liveness detection, address validation, geolocation verification, automated risk scoring, the ability to integrate various sources for identity data validation as well as ask any additional questions or collect further supporting documents. Each step of the process is configurable to meet your unique requirements.

How does iComply handle identity document verification?

We support one-to-one ID template matching for over 14,000 government issued identity documents in 142 languages, using edge-processing to detect security featues and OCR (optimical character recognition) to extract data from the document for a better user experience and to enable advanced data processing and automation within the platform.

How does iComply verify the user's identity matches photo IDs or data on file?

We complete biometric KYC locally, on the user’s device, by accessing their camera to scan their face while confirming user consent and liveness with randomized instructions – all of which can be easily configured in your adminstrative dashboard. Workflows can be adapted by country to ensure you adheere to the remote client verification regulations of every market you serve. No software development required.

What is the difference between CDD and EDD?

CDD is basic customer due diligence. EDD adds enhanced due diligence such as risk review, document collection, and manual analyst approval. iComply supports both.

How does iComply handle PEPs and sanctions screening as part of the KYC process?

Our AML risk screening solutions can be embedded into the the KYC module to provide access to real-time global lists and fuzzy matching logic for robust, global AML risk screening of PEPs, sanctions, watchlists, fitness, probity, financial crime, negative news and adverse media.

What triggers a KYC refresh, and how is it managed?

KYC Refreshes can be triggered by next review date, identity document expiry, custom supporting document expiry, activities flagged as high risk events, or risk profile changes. Our automation can notify your users and/or analysts and automatically collect updates.

How does iComply ensure compliance with global KYC regulations?

We comply with the FATF guidelines and their locally interpreted regulations spanning 195 countries. Whether you must adhere or report to FinCEN, FINTRAC, FCA, FSA, AUSTRAC, HKMA, SGA, or any other FIU (Financial Intelligence Unit) or financial services regulator – our AML compliance workflows are flexible and configurable to meet your requirements.

KYT Questions

What is KYT, and why is it important?

KYT (Know Your Transaction) ensures you monitor financial behavior—not just identity. It’s key for AML/CFT, detection of suspicious activity and suspicious transactions, fraud prevention, and sanctions compliance – specifically for those firms with higher volumes of transactions.

How does iComply monitor and analyze transactions for suspicious activity?

We use advanced algorithms including pattern recognition, anomaly detection, and configurable thresholds to flag suspicious transactions in real time.

Can iComply detect patterns indicative of money laundering or fraud?

Yes. Our behavioral analytics highlight unusual flows, layering patterns, smurfing, and other suspicious transaction activity.

Is iComply’s KYT module adaptable to different types of transactions, including crypto?

Yes. We support fiat, crypto, and hybrid flows across wallets, IBANs, or card numbers.

How are alerts and reports generated for suspicious transactions?

Alerts are scored by severity and routed to your compliance queue with full audit trails and can be escalated into cases for further review and reporting.

AML Questions

How does iComply handle sanctions, watchlists, and politically exposed persons (PEPs)?

We screen against 3,000+ global lists in real time, including OFAC, UN, EU, UK, FINTRAC, and regional PEP registers. Our AI-enhanced matching engine reduces false positives and identifies linked entities using fuzzy logic and relationship mapping.

What is your coverage for adverse media screening?

iComply provides adverse media screening in 142 officially recognized national languages across trusted global, regional, and local news sources. Categories can be configured to include financial crime, violent crime, sezual crime, terrorism, environmental violations, trafficking, and regulatory bulletins.

Can I configure my own risk scoring rules for AML alerts?

Yes. Our platform allows you to customize scoring thresholds, alert severity levels, and escalation paths based on customer profiles and jurisdictional requirements.

How does iComply support ongoing monitoring and reporting requirements?

Automated screening, alerts, and logs ensure continuous compliance. Reports can be exported via dashboard or API.

Privacy, Security, and Data Protection

How does iComply ensure the privacy and security of user data?

We use edge-computing to process data locally, AES-256 encryption, and only transmit data to third-parties under the direction of our clients.

Where is data stored and processed?

Data is processed and encrypted locally at the device level. No PII leaves the user’s device unless explicitly permitted. For clients using our SaaS application – data can be stored on hosted servers in the jurisdiction of your preference. Our most frequently requested data processing and storage facilities include Canada, UK, EU, US, and Australia. All locations include robust disaster recovery and redundancy protocols.

For enterprise customers operating on private cloud or on-premise applications – the data is only processed and stored according to your system configuration.

Is iComply compliant with GDPR, SOC2, ISO27001, and PIPEDA?

Yes. We exceed most industry standards and data privacy and protection regulations including GDPR, SOC 2 Type II, ISO27001, CCPA, PPIA, PIPEDA, and others. Upon client request, we are happy to undergo your preferred industry certification process(es) for your instance as part of your enterprise SLA.

How does iComply handle data retention and deletion requests?

We support granular data controls, including customizable retention schedules, deletion logs, user-controlled purging and management oversight configurations.

What measures are in place for breach prevention and response?

Real-time logging, real-time testing, anomaly alerts, and a documented breach response process reviewed quarterly by our privacy and security response team.

Does iComply send data to any third-party data processors?

Noto for data processing – our edge-native architecture eliminates reliance on external processors by default. However, where a client may be using third parties for enhanced data validation, screening, or enrichment – data is encrypted prior to transmition and a strict approach to data minimaliation is part of each custom integration.

Technical and Deployment

What deployment options are available with iComply?

SaaS, private cloud, and on-premise options are available.

How does iComply integrate with existing systems and workflows?

Through our REST API, webhooks, and SDKs, we support integration with CRMs, onboarding flows, and internal web or mobile applications.

Are APIs available for custom integrations?

Yes. We offer robust, well-documented APIs for identity, multi-factor authentication, screening, reporting, data import and export, and complex workflow management.

What is the typical timeline for deployment?

Basic SaaS accounts can be deployed in minutes. Advanced enterprise integrations typically range from 1–3 months.

Does iComply offer support for mobile and desktop platforms?

Yes. Our front-end works across mobile, desktop, and embedded web environments.

How are updates and new features rolled out?

All SaaS users receive updates automatically. Private and on-prem deployments are managed per SLA.

We were able to expand our operations globally within the first week of going live.

Get started with iComply today

Replace fragmented tools and reduce your total cost of compliance up to 90%..