Blog

Search

The Future of FATF Travel Rule and Regulatory Compliance

Understanding the FATF Travel Rule The Financial Action Task Force (FATF) Travel Rule is a significant regulation in the global fight against money laundering and terrorist financing. It mandates that financial institutions share certain information about the...

Challenges and Solutions in FATF Travel Rule Compliance

Complying with the Financial Action Task Force (FATF) Travel Rule presents several challenges for financial institutions. These challenges can hinder the effective implementation of compliance processes. This article explores...

Implementing FATF Travel Rule Compliance

The Financial Action Task Force (FATF) Travel Rule is essential for preventing money laundering and terrorist financing. Implementing compliance with this rule requires a strategic approach to ensure all regulatory requirements...

Understanding the FATF Travel Rule

The Financial Action Task Force (FATF) Travel Rule is a significant regulation in the global fight against money laundering and terrorist financing. It mandates that financial institutions share certain information about the...

Harnessing the Power of AML Screenings to Uncover Politically Exposed Persons (PEPs)

Politically Exposed Persons (PEPs) are individuals who hold prominent public positions and are considered higher risk for potential involvement in corruption and money laundering. AML screenings are essential for identifying and...

What are the Stages of Money-Laundering and How Can AML Checks Protect You

Money laundering is a complex process used by criminals to disguise the origins of illegally obtained money. Understanding the three stages of money laundering is essential for implementing effective Anti-Money Laundering (AML)...

Identity Verification with Liveness Detection: The Key to Preventing Spoofing Attacks

In the digital age, identity verification has become a cornerstone of security for financial institutions and businesses. However, traditional methods are increasingly vulnerable to spoofing attacks, where fraudsters use fake or...

Source of Funds: A Critical Step in Mitigating the Risk of Money Laundering

Identifying the source of funds is a crucial step in mitigating the risk of money laundering. By understanding where money originates, financial institutions can better assess the legitimacy of transactions and prevent illicit...

The Future of KYC: Trends and Innovations

The landscape of Know Your Customer (KYC) compliance is continually evolving, driven by technological advancements and changing regulatory requirements. This article explores the future of KYC, highlighting emerging trends and...

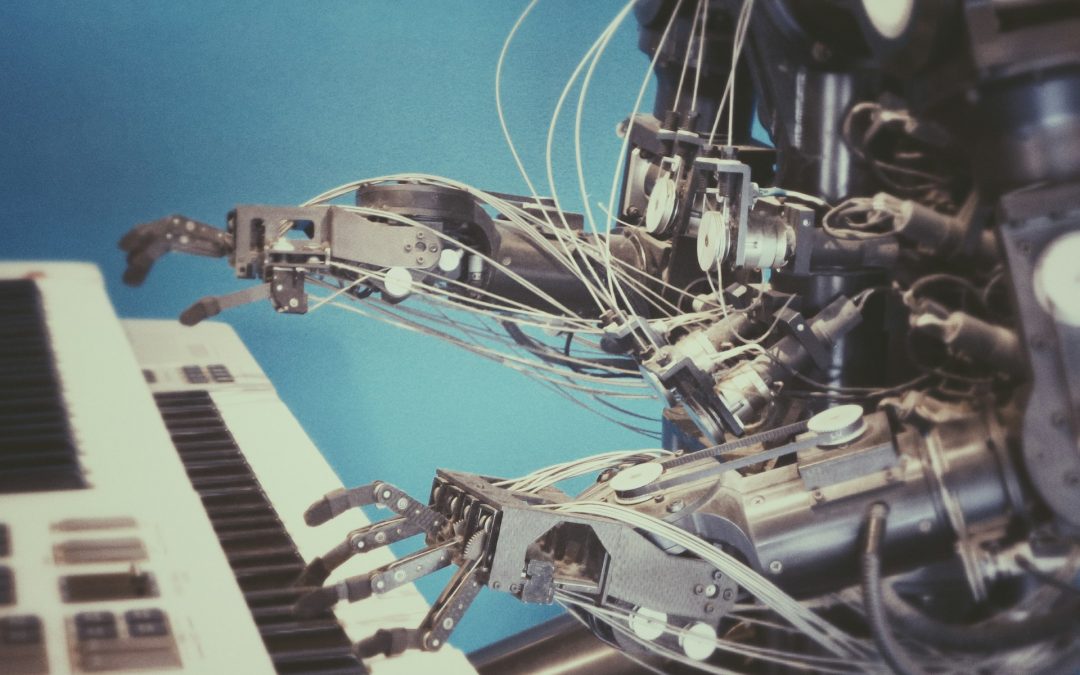

Innovative Technologies in Financial Crime Prevention

Financial crime is a significant threat to the global economy, affecting financial institutions, businesses, and individuals. To combat these sophisticated...

The Impact of RegTech on Global Financial Markets

Regulatory Technology, or RegTech, is significantly impacting global financial markets by transforming how financial institutions manage compliance and...

RegTech for SMEs: Simplifying Compliance for Small and Medium Businesses

Small and medium-sized enterprises (SMEs) face unique challenges in managing compliance due to limited resources and the increasing complexity of regulatory...

AI in RegTech: The Future of Compliance Automation

The rapid advancements in artificial intelligence (AI) are revolutionizing various industries, and the field of regulatory technology (RegTech) is no...

RegTech Solutions: Enhancing Compliance and Efficiency

Regulatory Technology, or RegTech, is rapidly becoming an essential component for organizations aiming to enhance compliance and efficiency. With the growing...

RegTech: Transforming Compliance with Innovative Technology

Regulatory Technology, commonly known as RegTech, is revolutionizing the way organizations manage compliance and regulatory requirements. With the increasing...

Future KYC Technology Trends: Emerging technologies and trends in the KYC space.

As regulations tighten and security threats evolve, the technologies driving Know Your Customer (KYC) processes are advancing rapidly. For compliance professionals, staying ahead means leveraging...

AI-Powered Identity Verification: Leveraging AI for more accurate and efficient identity verification.

Identity verification is a critical component of many industries, from finance to healthcare. Traditional methods of identity verification can be slow, error-prone, and costly. AI-powered identity...

Automated KYC Solutions: Tools and Software for Automating KYC Checks

The digital transformation of financial services and other sectors has made Know Your Customer (KYC) processes more critical than ever. Traditional manual KYC...

Blockchain for KYC: The Benefits and Applications of Blockchain in KYC

Blockchain technology is revolutionizing various sectors by providing secure, transparent, and decentralized solutions. In the realm of Know Your Customer...

AI in KYC: How artificial intelligence is transforming KYC processes

Artificial intelligence (AI) is revolutionizing various industries, and the realm of Know Your Customer (KYC) is no exception. AI-driven solutions are...

Advanced KYC Technologies: Enhancing Security with AI and Blockchain

As the digital landscape continues to evolve, financial institutions and other organizations face increasing challenges in verifying identities and preventing...